Welcome to this Saving Money Calculator!

Below is a simple calculator for calculating your savings over a period of time. We’ll show you how to use it, some examples, things to save up for, benefits, and more!

If you have any questions or suggestions let us know and we’d be glad to help in any way we can!

Saving Money Calculator

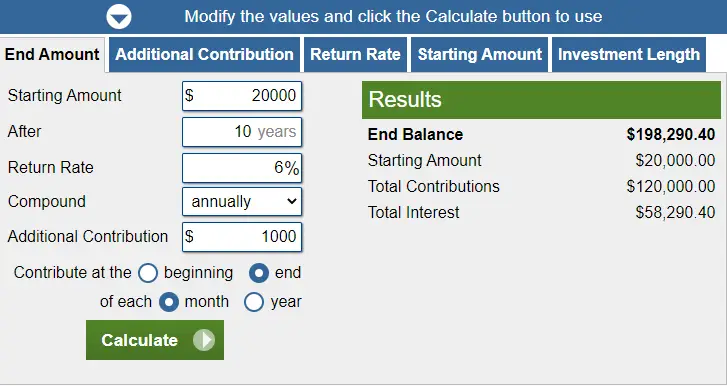

The best saving money calculator that we have found at Teen Financial Freedom is this one right here:

https://www.calculator.net/investment-calculator.html

What To Save Money For

This part of saving money is usually people’s favorite! There are so many thing we could save for and it’s really fun to set these goals. If you’re interested in some ideas though, here are a few:

A Big Ticket Item

Almost everybody can think of something in this category fairly quickly. It could be a gaming console (Xbox, Playstation, or gaming computer), a dirt bike (an item on my personal list, lol), a pair of high end headphones, a new laptop, crazy looking shoes (my cousin has an impressive collection), or even an event or seminar you’re interested in attending!

All of us have hobbies and there are always bigger ticket items that would make that hobby even more enjoyable for us. As a kid, a big ticket item could be just a few hundred dollars, but as a teen or young adult with a job it usually becomes more realistic to save up for even bigger things.

Your First Car

Depending on your personal situation and age this could be an important item you’d like to buy in the near or far future.

In my personal case I’m homeschooled and my job is within eyesight from my house so I honestly don’t have a need for a car! If you’re in a situation like me, I would encourage you to not rush to buy one immediately. They can get quite pricey after gas, repairs, and insurance are accounted for.

Whatever you do, DON’T go into debt for one! And as a young person, I would generally suggest not buying your car brand new (though if you can afford it and really want to, by all means, go ahead!)

Although, if you’re in a situation where you know you’ll be buying a car, this is a great item to save up for!

Everyone’s budget and driving abilities are different so I won’t make any specific suggestions but I do know there are some excellent online resources out there to assist you in your research (though I would like to make a strong suggestion to buy your car used).

College Expenses

College expenses can be killer! Saving up for this is huge. Do all you can to avoid absolutely all student loans. In fact, before starting college it would be a great idea to do three things:

- Figure out how to cut your expenses as much as you can and get them as low as possible. Figure out how much you’ll need to complete your degree.

- Figure out how to close the gap between where you are right now financially, and if you’ll be making enough. Part time jobs, scholarships, and grants are huge.

- Set boundaries with student loans. I’m personally against all student loans and think it’s better to stop taking classes temporarily to save up more cash, but you need to figure out your stance on it. Do you want to avoid debt at all costs, or are you ok with some? If so, how much? What’s the maximum you’ll tolerate?

If you’re interested in reading more on how to save for college, check out these two articles:

- How to Save for College in High School

- How to Start Saving for College at Age 14

Investing

If you’ve got some cash set aside in short term savings, and you’re not saving up for anything in particular at the moment, investing your money is an excellent idea!

(Note: we might have a post in the works soon about an “investment” platform that will really blow your mind. Stay tuned!)

As young people we have an incredible advantage to be able to save and invest so much money now, before our expenses and responsibilities start to increase.

Even when things like college come into the picture and you have other things you need to start saving money for, you should ALWAYS keep the habit of setting aside money for the future. One of the biggest regrets I constantly hear from adults in the financial space is “If only I had known. If only I had started investing at your age. You guys are so blessed to have this information at your age.”

Take heed! Regret is an awful feeling, and what would make it even worse is looking back 20 years from now and saying “Not only did I have the opportunity, and understand that I should have started investing, but I disregarded all that advice and decided to spend my money.”

Ouch. 📉

Interested in investing? Don’t know where to start? These articles will answer all your questions!

- Investment Calculator

- Best Stocks For A Teenager To Invest In

- Vanguard Roth IRA for Teenagers

- Best Ways To Start Investing With Little Money

Or just. . . Saving for the sake of Saving!

You don’t have to save money just to spend it. Even if you’re not saving up for a specific item or expense, you should absolutely still save!

Kids or younger teens shouldn’t need a very large emergency fund or anything but if you would still like one, something simple like $50-$100 would be a great start!

Once you start accumulating some bills (subscriptions, gas, insurance, car repairs, phone plan) it would be an excellent idea to save up for a simple emergency fund.

It doesn’t have to be a whole lot (just a month or two worth of expenses). $500 or $1000 would be a great start! Once you’ve accumulated your emergency fund make sure you’re keeping it somewhere out of sight.

Out of sight, out of mind! If you try to be lazy like the old me and keep it in your checking account or a savings account with the same bank (3 clicks and I can transfer the money between accounts instantly), your “emergency” fund will. . . Disappear. Weird how it just leaks out of your account, huh? 🤦♂️

Saving Money Examples

If you need some examples of how this calculator works, here you go!

John is saving for a car. He currently has $1,000 and he is trying to reach $5,000. He is 14 years old so he has 2 years to reach his goal. He will need to save $167 every month to reach his goal.

Joe is saving for a new computer by mowing lawns over the summer. He currently has $250 saved up. He wants to reach $1,000 by the end of summer in 3 months. He has to save $250 each month to reach $1,000.

Jane is saving for college starting at age 14. She currently has $5,000 saved up. She is trying to reach $30,000 by age 18 for college. She has to save $520 a month to hit her college savings goal.

Benefits of Saving Money

As discussed earlier, there are so many great reasons to save money. Saving money comes down to preparing for the future.

You have to set aside some of your money now in order to have enough money to meet your goals in the future.

It might be hard in the moment when you see a big chunk of money go into savings. But, when you finally reach that savings goal it feels amazing.

Those who save instead of spend will be far more financially well off in the future. There’s so many things you should save for, but where do you find all this money to save?

How To Save More Money

When it comes down to it, you need to control your spending in order to save more.

Let’s be real, there’s some expenses that you don’t get to control. Insurance, phone payments, gas, etc. There’s not much you can do there.

But, you can control other expenses. Things like food, subscriptions, fun nights out, etc. These are the things that you can cut back on to save more money.

A few dollars here and there might not seem like a lot, but before you know it, it adds up to hundreds of dollars. The more money you save with your everyday expenses, the easier it will be to reach your saving goals.

How To Make More Money

There might be a moment in time when you simply are not making enough money in order to save as much as you want to every month. When this time comes, you will need to find another way to make more money.

Get A Part Time Job

Most teens turn to part time jobs in order to make more money. Which is definitely a great idea as a teen. You can make decent money and learn some valuable skills that will help you in the future.

If you’re interested in getting a part time job as a teen, I recommend you check out these posts:

Start A Business

Another option is for you to start a business. It’s a but more risky but you could make good money with it.

When it comes to money, the more you risk, the more money you’ll make.

Remember that principle when it comes to starting a business, and you’ll be rolling it in very soon!

Here are a few resources for you to check out if you are interested in business:

- 8 Businesses That Make Money While You Sleep

- Teenage Entrepreneur Stories

- Business Ideas For Students With Low Investment in 2020

The Takeaway

I really hope you enjoyed this saving money calculator. I hope you played around with the numbers to figure out exactly how much you need to save every month to reach your saving goal. There are a lot of great things that you should save for, especially in your teenage years. In order to save more money, you’ll need to cut back on your spending and find ways to make more money! Be sure to check out: I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works. Happy saving! Good luck!