Welcome to How To Save Money As A Teenager!

Everyone wants to be a millionaire.

Some want to acquire money so that they can change the world (for better or for worse). Others want money so that they can live comfortably and invest it to have a solid retirement plan that will allow them to enjoy their older age. Others want money so that they can spend it and live luxurious lifestyles that will be admired by the younger generations and coveted by the older generations.

Whatever your motive is, one thing is for sure. You will never be able to have enough money to achieve your dreams unless you save! Don’t worry, with discipline and help from us here at Teen Financial Freedom, you’ll be investing your money and ruling the world in no time.

Discipline

This word always gives me flashbacks to when I was a kid and had to sit in the corner because of something bad I did. However, discipline is an important thing to have in your life, whether young or old.

When I say discipline, I do not mean to sit yourself in the corner every time you order pizza or whenever you buy the cute t-shirt.

When I say discipline, I mean you have to set goals for yourself and stick to them. You need to decide how much you want to save, and create a plan that will allow you to meet your goal. Maybe your goal is to save 5% or maybe your goal is to save 50%. No matter what you decide, you need to stick to your plan.

In my opinion, this is the hardest step when it comes to saving money, espically as a teenager. It’s easy to find things to blow your money on, and before you know it, you don’t have any money.

That is why it is so important to make saving a priority. To do this, you need to save before you spend. My favorite way to do this is to set up automatic transactions on your bank accounts.

The best way to set it up is to link your direct deposit to your checking account. If you don’t have direct deposit, just deposit your income into your checking account. Then, set up an automatic transfer to go to your savings account. If you want to save $100 a month, then set up a transaction that takes $100 from your checking and puts it in your savings every month.

Dedication

Saving money isn’t something you should do for a few weeks, months, or years and then stop. You should be saving money from the time you can get a job until the time that you retire. Even then, you should try to be restrictive with what you buy, but still be able to enjoy your retirement.

We understand that sometimes you want to save money just for a certain item, but why stop there? Continue saving money once you reach your goal and if you’re still ready to spend your hard-earned cash, then more power to you. But always go the extra mile and exceed your savings goal.

You should always be increasing your savings, but it is also important to invest. Investment accounts yield way better returns than savings accounts. Currently, a high-interest savings account gives you around 0.50-3% interest every year, which is barely enough to keep up with inflation. While the stock market generally yields 10% interest every year.

If you invest some of your money as well, your money will start to do the work for you, and you’ll find yourself with years of compound interest stock-piled.

The key is to both save money and invest money. Savings are used for large purchases coming up in the next 10 years or so. Investing is much more long-term and is used to grow your money over time so you have much more money in the future.

Saving Money Tools

Before you can start investing your money, you must start saving. Everyone knows what saving money is, although many do not know how to do it the right way.

Yes, there is a “right way” to save money. Start using a savings calculator to know exactly how much you need to save every month to get to your goal. Your goal can be anything from saving for retirement to saving for a pair of Yeezy’s.

One thing is certain, though, and that is that you should have a sizable emergency fun. Generally, you should have about $500 in a savings account as a minimal emergency fund.

But, experts suggest building an emergency fund that is at least 3-6 months of expenses. That means that if you make $50,000 a year, your emergency fund should be anywhere from $12,000 to $25,000.

Use our savings calculator to see exactly how much you need to save!

There are other tools that can help you save money. As I mentioned earlier you should set up automatic transfers on your bank account, to automatically save money each month. Once it’s out of your checking account, you’re much less likely to spend it as it’s “out of sight, out of mind”.

Other ways include budgeting, which will be touched on later, and trying to find discounts and deals. If you really take the time to shop around for your purchases, you can save a lot of money.

Savings Accounts

Most banks offer savings accounts at a very low cost, or even for free. A lot of banks do require that you have a minimum balance, however, or they will charge you a fee.

This shouldn’t matter too much though, because you shouldn’t be withdrawing money from your savings account unless it is an emergency, or you had specific intentions for the money.

When you’re opening a bank account, you should shop around. There are tons of amazing options out there that offer amazing benefits for free.

Here are some of the best bank accounts available in 2020.

For example, on savings accounts, you want to look for accounts with high interest rates, no minimum balances, and no fees.

On checking accounts, you want to look for accounts with no minimum balance, no overdraft fees, and no other fees.

If you want money to eat out with your friends or buy those new shoes, then you should pay yourself with what is left after saving and paying bills (if you have them.)

Learn the benefits of teenage jobs!

Disadvantages Of Working

Balancing a job and school isn’t as easy as it seems. When you get a job, you must have some form of discipline. You need to allocate time for school, work, homework, and chores if you have them. While you still may be able to save up some money without a job, you will want to have at least a side gig to make enough money for a savings account.

See more about all the disadvantages to after school jobs!

Other Ways To Save Money As A Teenager

Some teens cannot have a job because of certain reasons, such as a lack of transportation, school, parents, etc. It may be hard to make enough income at this point of your life so that you can start saving and investing.

Although you may not make as much money as you would with a traditional job, doing small odd jobs and errands for you neighbors will start to add up.

You would be amazed at how much money you can make in a day by just mowing lawns. If you don’t have crazy spending habits, that is!

Learn How To Save Money Without A Job!

Avoid Normal Spending Habits

If you’re anything like me, your purchases can get a little pricey. A lot of hobbies can be very expensive, like cars and shoe collecting.

While I encourage you to have hobbies that you’re very passionate about, you might have to restrain yourself if you tend to be loose with your wallet.

There IS always cheaper alternatives, but unfortunately due to brand loyalty and societal judgement, teens will often choose to buy the more expensive option.

There are things that you should spend your money on as a teenager so that you will thank yourself in the future.

Learn more about the spending habits of teens in 2020!

What To Spend Money On

There are things that us here at Teen Financial Freedom that we suggest you spend money on.

First off, obviously, you want to get a savings account and “pay” into the account for an emergency fund. After that, you need something which most everyone needs.

You need to buy a car. Without a car, it will be more difficult to acquire and hold a job. After a job, save for college and then invest your money.

Assuming that you do all that, great, you are already doing better than almost everyone else your age. Now it’s time to invest into yourself.

There are several ways to do this. First of all, education is the best form of investing into yourself. Learning something new will go a long way in the future. But, you can also invest into your health with gym memberships and many more things!

At the end of the day, you’re still a teenager and you should enjoy yourself. If you’ve managed to save some money, great! But, don’t go crazy. Enjoy yourself, have fun, and try not to stress too much about money, that comes later.

You want to make sure that you’re saving money, but not to the point where your daily life is starting to suck because you can’t do anything with the money you’re making because it is all in your savings.

More on What You Should Buy with Your Money as a Teenager in 2020.

How Much To Save

I know you must be getting sick of reading this, but you need to have an emergency fund. This is something that I cannot stress enough, simply because it is so important.

After you have saved up enough so that you feel like in an emergency you will be covered in an emergency, you can start diverting your money elsewhere.

Really, you should try to be saving and using 80% of your money (car, college, other bills, etc.). The other 20% can be spent on food and going out with friends.

I know that for some, this may not be a reasonable split of your money. However, this is the goal you should be shooting for.

Check out How Much a Should a Teenager Save from a Paycheck for more information!

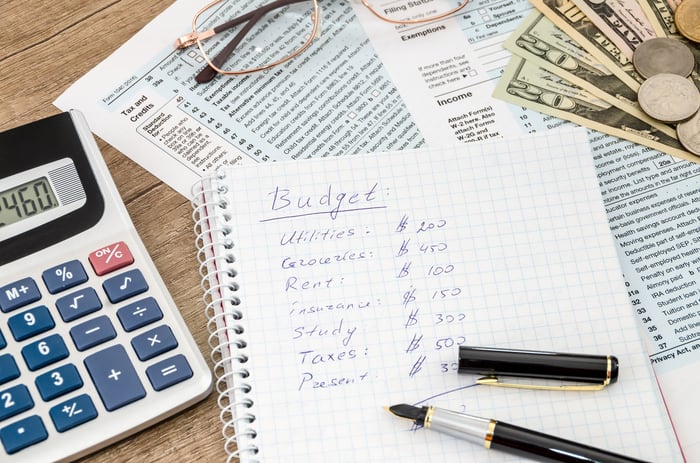

Budgeting

Making a strict budget and sticking to it is one of the most important things you can do to save money.

With a well-planned budget, you will always know where your money is going.

I suggest that you use a “0 based budget.” This type of budget is when you use the all the money out of your paycheck to “pay” everything.

You pay your bills, your savings accounts, and even pay yourself. This is simply dividing the money to important things, putting a majority of the money left after bills in a savings account or investments, and then saving some for yourself.

With this kind of budget, you will be able to know how much money you can save and spend right when you get your paycheck.

Check out 10 Budgeting Tips for Teens for more tips on how to make a budget.

FAQ

How much should a teenager save?

A teenager should try to save 10-20% of their income at the very least.

Where should a teenager save their money?

The best place for a teenager to save their money is a savings account. They should avoid putting too much money in investment accounts because they will need their savings in the short-term.

What should a teenager spend their money on?

Teenagers should invest in themselves when it comes to spending money. They should buy books, courses, and other educational items that will teach them new skills and knowledge.

The Takeaway

Hopefully this post has given you enough information so that you can start saving and be on your way to financial freedom! You have all of the information that you will need to save at hand, now it just comes down to you doing it. The final piece of advice that I will suggest is to get excited about saving! I highly recommend that you read this book: Money $mart Teens: 48 Interactive Lessons for Understanding, Making, Saving, and Spending Money. Be excited that you have the knowledge to save and that you’re one step closer to becoming a millionaire philanthropist (or the new Dr. Evil, whatever your heart desires.)