Welcome to this post about Vanguard Roth IRA for teenagers!

In this post, we’ll be discussing the pros and cons of a Vanguard Roth IRA, how to set one up, what a Roth IRA is, and other alternative accounts and providers you could use. So let’s get started!

What is a Roth IRA?

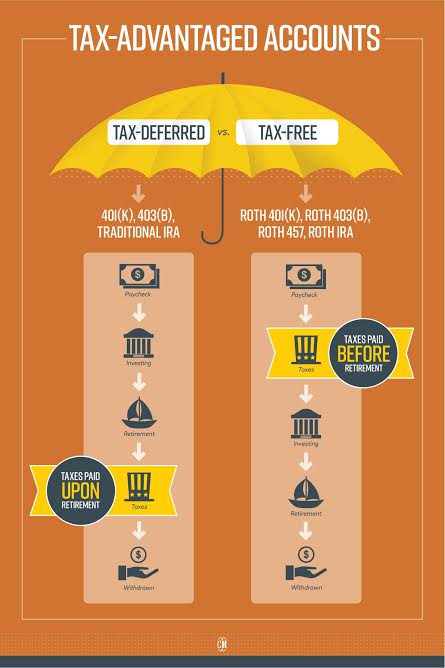

A Roth IRA is a specific type of retirement account. The biggest strength of a Roth is that it allows you to pay taxes on the money you put into the account now so it can grow tax-free for the rest of your life (technically, you’re funding the account with after-tax money)!

It has a very close relative, the Traditional IRA. With this account, you don’t have to pay any taxes on the money you put in until retirement and when you start withdrawing the funds.

Each account has its pros and cons. Some say the Roth IRA is the far better account and others say the Traditional IRA is the superior one. Personally, I think having both is the best strategy, though I do favor the Roth IRA over a traditional one.

Roth IRA vs. Traditional Roth

I won’t go down this rabbit hole too deep, but there is a big advantage that the Roth holds that I wanted to mention. Granted, I’m 16 and don’t hold a finance degree or anything of the sorts, but this is my best objective opinion.

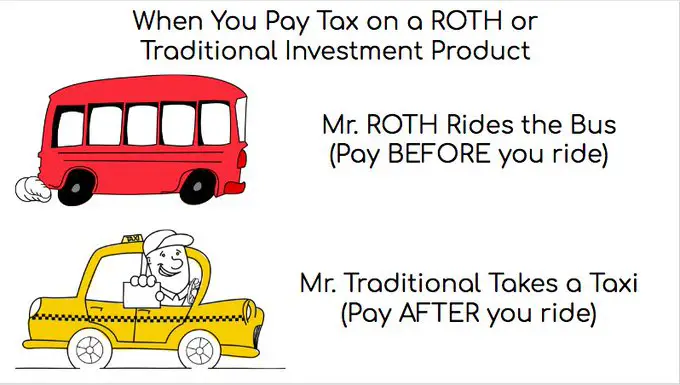

I would rather pay taxes now on the small contributions I’m making to my Roth, compared to paying taxes on the massive amounts of money I’ll be withdrawing from the account.

For example, say you made a $5,000 contribution to your account this year with after-tax money. It can now grow and compound for 20, 30, or 40 years (depending on your age) and with a decent return on your investment that single contribution could easily be over $70,000 by the time you’re eligible to start withdrawing from your account.

Personally, I would rather pay the taxes on that $5,000 instead of the $70,000.

Overall, it is a good idea to just have both! It doesn’t hurt anything!

Extra Reading:

If you still want to learn more about the differences between the two here are some useful articles and forums I came across when researching about it:

- Why do some people believe tax rates will rise in the future?

- The Future: Where Will Tax Brackets Go In 30 Years?

- Guessing Tax Rates in 2030

- How are Roth IRA contributions taxed?

How to Setup a Roth IRA with Vanguard

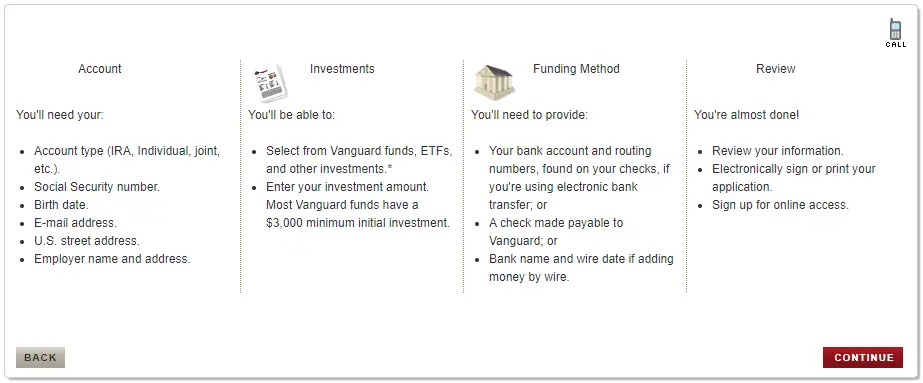

So now the fun begins! You’ve learned about Roth IRAs and are interested in setting one up. Here are the steps you’ll need to take and what you’ll need to set it up.

What You’ll Need for the Setup:

- $1,000 Cash (minimum amount for a Vanguard fund).

- Bank account number and routing number (can also fund the account with a check or by rolling over a different retirement account).

- Your employer’s information or a source of “earned” income.

- Personal information (phone number, email, home address, social security number, etc)

- A cell phone (to call a representative to help you set up the account)

- Very likely a parent will be needed to walk you through the process.

The Steps to Take:

I scoured the internet almost all day for how to set up a Vanguard Roth IRA for specifically teens, but to no avail! Since I already have a Roth IRA myself and am not looking to set another one up, here are the steps that you will probably need to take (though I am not sure firsthand).

There are really only three steps:

- Gather the information needed (listed above)

- Call 800-551-8631 during business hours (8 a.m. to 10 p.m. EST)

- Fund your account, and buy your first investment!

- Bonus step: Celebrate (preferably with cake)! 🎉

Pretty easy, huh? Turns out that after all that research, teens are unable to set up their accounts with Vanguard online. You’ll need to call and ask a representative to help you set it up.

To be honest, that makes everything so much easier because all you’ll have to do is pick up the phone, say “Hi, I’d like to set up a Roth IRA for a minor,” and just provide the information the representative asks for! Piece of cake!

Alternative Roth IRA Providers

It seemed to be the general consensus that Vanguard’s investing experience is stuck in the 90s. As of late though, it looks like they have improved their software and sign up process, so kudos to them (and don’t get me wrong, Vanguard has everyone beat with their funds, hands down)!

Still, other brokerages like TD Ameritrade, Charles Schwab, and Fidelity have excellent investing dashboards with tons of features and versatility. Personally I use TD Ameritrade as the broker for my Roth IRA and have been satisfied so far (I did get burned on commissions super badly, though it was my fault).

If you’re looking for the best Roth IRA or Traditional IRA account providers, here is a list of the top 12. Some of the top ones are:

Recently there has been a bit of a price and feature war in the investing space with Charles Scwhab leading the pack. A close second would be TD Ameritrade (which was actually just bought by Charles Scwhab). There’s never been a better time to start investing with every company out there slashing prices and introducing free features!

The Takeaway

The process is very simple for setting up a Roth IRA with Vanguard for teens, but it will require you calling the company to set it up and having a minimum $1000 to invest.

If you don’t have $1000 or would prefer more features or a higher-end investor’s dashboard, check out the other top five Roth IRA providers listed above (every single one has no minimum and is comission free).

For another resource, check out: The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk.

Thank you for reading this post! Hopefully you found it helpful.

If you have any questions about Vanguard or Roth IRAs in general, please leave a comment below and we’ll get back to you as soon as we can!