Welcome to this post about the 50 stocks in my portfolio as a teenager in 2022!

I recently hit a milestone…I acquired my 50th stock in my portfolio. That may seem like a lot to you, or maybe if you’re an experienced investor, like nothing at all.

For context, I’ve built this portfolio in about a year. While I’ve been investing longer than that, I really got serious about individual stocks last June when the markets were just starting to recover from the big crash.

I had always traded in custodial accounts, so I got even more serious about investing when I turned 18 and was able to open up a few more investment accounts.

I had a lot of fun writing the 10 Best Long Term Stocks To Buy Right Now In 2021 post, and want to do something similar here.

Anyways, today I want to share every stock I own with you. I’ll be going over index funds, value stocks, growth stocks, blue chips, and penny stocks.

But first, I think we should talk about how many stocks one should own because I may have gotten a little carried away.

How Many Stocks Should You Own?

While there’s not really a magic number of stocks you should own, there is a sweet spot you should shoot for. I would say that number is around 20-30 stocks. Fun fact, I looked this up after I wrote this section and found that Investopedia also suggests owning 20-30 stocks.

Anything below that amount and you’re not diversified enough. Generally people say that no individual stock you own should take up more than 5% of your portfolio. If you do the math, that means you have to have a minimum of 20 stocks, assuming that each takes up 5%.

Anything above 30 stocks and you may start to find that it’s too hard to keep track of everything. You always want to be following the most recent news from each company and there’s only so many companies you can do that with. Not to mention, at some point you can over diversify to the point where your portfolio doesn’t see any significant gains. However, if you have lots of time on your hands, you may be just fine investing in more than 30 companies.

Invest in Your Convictional Beliefs

On the other side of diversification, there’s something to be said about investing in what you believe in.

I recently heard Andrei Jikh say:

“Invest in your convictional beliefs to the nth degree.”

Two words in this quote make it kind of hard to understand, so let’s define them:

- Convictional – A firmly held belief or opinion.

- Nth – Numbered with an unspecified or indefinitely large number.

So essentially Andrei was suggesting you should invest in what you believe in the most. Think about what things in your life you believe to be absolutely true without a doubt. Then, put everything you have into that.

This can be applied to yourself as your #1 investment should always be you. But, it can also be applied to stocks. What stocks do you believe in the most? If you put some faith in what you believe, I’m sure you’ll see it pay off.

My Portfolio

Now that we’ve got that out of the way, let’s talk about the 50 stocks in my portfolio. For each stock, I’m going to share the name, category, and the percentage that makes up my portfolio. Each stock takes up an average of 2% of my portfolio, but most take up less than 1%.

I wouldn’t be sharing the prices or how many shares I own for privacy reasons and also because these numbers are always changing. Just know that for some cheap stocks I own thousands of shares, while I might only own fractional shares of expensive stocks.

For a few stocks, I might share some additional details. It might be an explanation of why I bought, why I own so much, how it has performed, or how I expect it to do in the future.

Index Funds

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)

Index funds are a great way to invest in the market overall. Instead of owning individual stocks, you can buy shares of an index fund which contains those stocks within it. For example, Apple might make up 2% of an S&P 500 index fund. This means if you invested $100 in this fund, $2 of that would be invested into Apple. It’s a great way to invest due to it’s simplicity, diversification, and scalability.

The first major category I started investing in was index funds. I put a sizeable amount into an S&P 500 index fund back in March of 2020 when the markets dropped. To date, this investment has grown by 43%. Due to the size of this investment and it’s growth, it has been my most profitable investment I’ve ever made.

- S&P 500 Index Fund – 40% of Portfolio

Value Stocks

Value stock investing is when you buy a stock because it is undervalued. For whatever reason, the market has valued these stocks lower than you believe they are worth. For example, a company might publish earnings that are lower than expected. This might cause the market to sell this stock, thus lowering the value. While the financials temporarily look bad, you believe the value of the service this company offers hasn’t changed. This form of investing follows that saying you hear all of the time, “buy low sell high”. You want to buy stocks when they are valued low, and sell stocks when they are valued high.

A few months late in June, the markets were beginning to recover. However, a few key industries had taken a major hit in the stock market and were running the risk of going bankrupt. Airlines, cruise lines, and banks are the industries that I’m talking about. These investments had some serious risk associated with them as we had no idea when our world would go back to normal in the heart of this pandemic. However, with high risk comes high reward and as our economy as recovered, these stocks have performed extremely well.

2. American Airlines – 1% of Portfolio

3. Bank of America – 1% of Portfolio

4. Carnival Cruise Lines – 1% of Portfolio

5. Delta Airlines – 2% of Portfolio – I vividly recall thinking that Delta might be one of the companies that go bankrupt, but I figured I would take the risk anyway. It’s panned out pretty good so far as I’m up 47% since I made that investment.

6. Norwegian Cruise Lines – 2% of Portfolio

7. Royal Caribbean Cruise Lines – 5% of Portfolio

8. Southwest Airlines – 2% of Portfolio

9. Wells Fargo – 1% of of Portfolio

Growth Stocks

Rather than trying to buy stocks when they are undervalued, growth stock investing is based on the idea that certain stocks are bound to grow in the future. For example, someone (me) might choose to invest in Tesla simply because they believe they are the car manufacturer of the future. Maybe the stock is already priced fair or even high right now, however you believe it will be even higher in the future.

The largest category in my portfolio is growth stocks. This if for two reasons. One, I’m very optimistic about stock prices because I have only lived through a few brief recessions. I tend to think that stocks can only go up even though that’s a very dangerous way of thinking. The other reason I do so much growth stock investing is because most stocks that I can afford fall into this category.

10. Amkor Technologies – 1% of Portfolio

11. AT&T – <1% of Portfolio

12. Axon – 4% of Portfolio – I invested in Axon because they manufacture body cameras used by police. Currently, this investment is only up 40%, but at one point it was up 120%!!

13. Crown Castle – 5% of Portfolio – I remember doing a lot of research on Crown Castle because they were one of the more expensive stocks I was considering. I’m not exactly sure what they do, but they seem to have ties to the real estate and 5g industries, both of which I expect to boom in the future.

14. Exxon Mobile – 2% of Portfolio

15. Intel – 2% of Portfolio

16. NeoPhotonics – <1% of Portfolio – Fun fact, I know nothing about what this company does. I only invested in them because I had a few extra dollars sitting in my brokerage account one time.

17. Sirus XM – <1% of Portfolio

18. Sony – 3% of Portfolio

19. Uber – 1% of Portfolio – Uber stock has been quite volatile throughout this pandemic, but has seen some great highs along the way.

20. Verizon – 2% of Portfolio

21. Zix Corporation – <1% of Portfolio

22. Zynga – <1% of Portfolio

23. Tattooed Chef – <1% of Portfolio

24. Tesla – <1% of Portfolio – As I mentioned earlier, I believe Tesla is the car manufacturer of the future. The stock price may be high, but I believe it will continue to rise even further.

25. Palantir – 1% of Portfolio

26. Voyager Digital- <1% of Portfolio

27. Corsair Gaming- <1% of Portfolio

Blue Chips

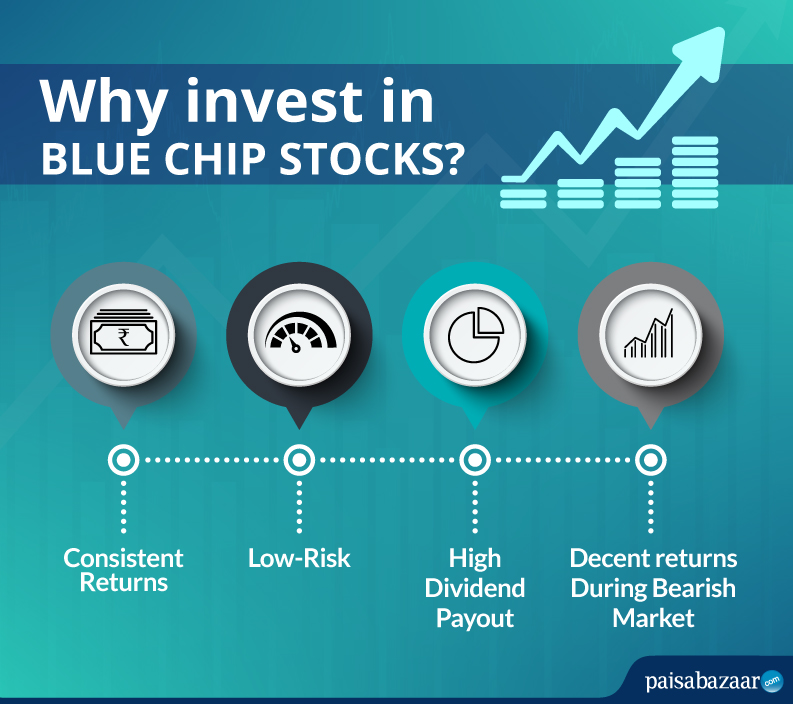

Blue Chips stocks are safety stocks. They are the big, well-known companies that have good reputations. For example, Coca Cola is a classic blue chip stock that actually has been one of Warren Buffet’s largest holdings. They aren’t volatile and often pay dividends. Blue chips are a great option for people looking for consistency, mild growth, and dividend payouts.

For the longest time, I couldn’t invest in most blue chips because I couldn’t afford it. These are often the most expensive stocks which makes them hard to invest in. I really didn’t start buying blue chips until I got the ability to buy fractional shares through Charles Schwab. Most of the blue chips that I own make up FAANG which is a powerhouse group of tech stocks including Facebook, Apple, Amazon, Netflix, and Google.

28. Coca Cola – 1% of Portfolio

29. Kroger – 1% of Portfolio

30. Alphabet (Google) – <1% of Portfolio – As a firm believer in Google products, I can’t help but think that this company will continue to pave the way for decades to come.

31. Amazon – <1% of Portfolio

32. Apple – <1% of Portfolio – While I like Apple products, I am slightly concerned at how they will innovate in the future and believe they may have reached their peak.

33. Johnson & Johnson – <1% of Portfolio

34. Microsoft – <1% of Portfolio

35. Netflix – <1% of Portfolio

36. PayPal – <1% of Portfolio

37. Walgreens – <1% of Portfolio

Penny Stocks

Penny stocks are stocks that cost literal pennies (most of the time). The best way to think about penny stocks is that they are the exact opposite of blue chip stocks. They are small, new companies that have unproven track records. They are extremely volatile and risky. I don’t recommend you try this unless you know what you are doing. However, they have massive upside meaning that if you get them right, they can make you a lot of money.

Penny stocks have been the newest addition to my portfolio and they have quickly become my favorite. That’s kind of ironic when you realize that I’ve lost more money than I’ve gained with penny stocks. However, I only started a few months ago and I truly believe that at least one of the companies I’m about to mention will make it big. And when they do, I hope they manage to pay for my losses on the rest of them.

38. Adma Biologics – <1% of Portfolio

39. Brazil Minerals – <1% of Portfolio

40. Exela Technologies – <1% of Portfolio

41. Gentech Holdings – <1% of Portfolio

42. Guardion Health Services – <1% of Portfolio

43. Oragenics – <1% of Portfolio

44. Sunshine Biopharmaceuticals – 7% of Portfolio – SBFM is the largest individual stock position in my portfolio. While it is a penny stock, I believe it might be worth dollars very soon. They have a COVID pill and a cancer pill in the works, and if either is successful this stock will skyrocket.

45. Zomedica – <1% of Portfolio

46. Creative Medical Technologies – 1% of Portfolio

47. IMD Companies – 1% of Portfolio

48. Enzolytics – <1% of Portfolio

49. Therapeutic Solutions International – <1% of Portfolio

50. Regen Biopharmaceuticals – <1% of Portfolio

The Takeaway

That’s it! I hope you enjoyed this post about the 50 stocks in my portfolio as a teenager! Remember, some diversification is necessary. However, you should also invest in your convictional beliefs to the nth degree. Please leave any comments, questions, or concerns down below. Otherwise, best of luck on your investing journey!