Welcome to this post about simple ways to save money!

You’re walking around the mall and store lights beam from all around you. New products are displayed through the window, and some stores have huge SALE banners. These displays are like a water bottle in the middle of a desert- tempting you to go in and have it.

Holding several bags of clothes, shoes, and other products that you are holding with every bit of strength you have, you think one more can’t hurt! With this mentality, you go in inside the store and come out with one more loop around your arm.

However, this mentality doesn’t just affect the number of bags you are holding in your hand, but has an even bigger effect on your finances. How many dollars did you just spend on those products inside the bag? Was it worth it? In order to answer that question, think How many of those products will I actually use in my daily life?

Asking yourself this question is one thing you can do to save money when buying products from the store, mall, or online shopping. If asking yourself just one question can save lots of money, think about all the other things you can do that will save you even more money!

This blog is all about simple ways you can save money, and I mean really simple ways. If you’re like me, you would give up on saving money just by reading about the things you have to do. So, as a solution, I am writing this post on simple things anyone can do to help save money. Depending on your personal habits, these ways may not save tons and tons of money, but if you think about it, every dollar counts.

Hopefully, these tips will help you spend less on things you don’t really need, and by that, save money in the long run. It is always important to think about the future, as you want to be comfortable and happy for the rest of your life. Happiness doesn’t come from money, but money does buy things that are necessary for you to live comfortably. So, read on with this post about simple ways to save money!

1. Record your expenses

Recording your expenses is a great way to understand how much you’re spending, and on what products you are spending on. It not only helps you keep track of your finances, but also realize any mistakes you’ve been making with your buying habits.

“The first step to start saving money is to figure out how much you spend. Keep track of all your expenses—that means every coffee, household item and cash tip. Once you have your data, organize the numbers by categories, such as gas, groceries and mortgage, and total each amount. Use your credit card and bank statements to make sure you’re accurate—and don’t forget any.” (https://bettermoneyhabits.bankofamerica.com)

For example, if you record your expenses and realize that you are spending too much on clothes, you now know that you shouldn’t buy that many clothes in the future. Recording your expenses is a great and simple way to reduce your spending and in total, save money!

2. Create a budget plan

“Once you have an idea of what you spend in a month, you can begin to organize your recorded expenses into a workable budget. Your budget should outline how your expenses measure up to your income—so you can plan your spending and limit overspending. Be sure to factor in expenses that occur regularly but not every month, such as car maintenance.” (https://betteroneyhabits.bankofamerica.com)

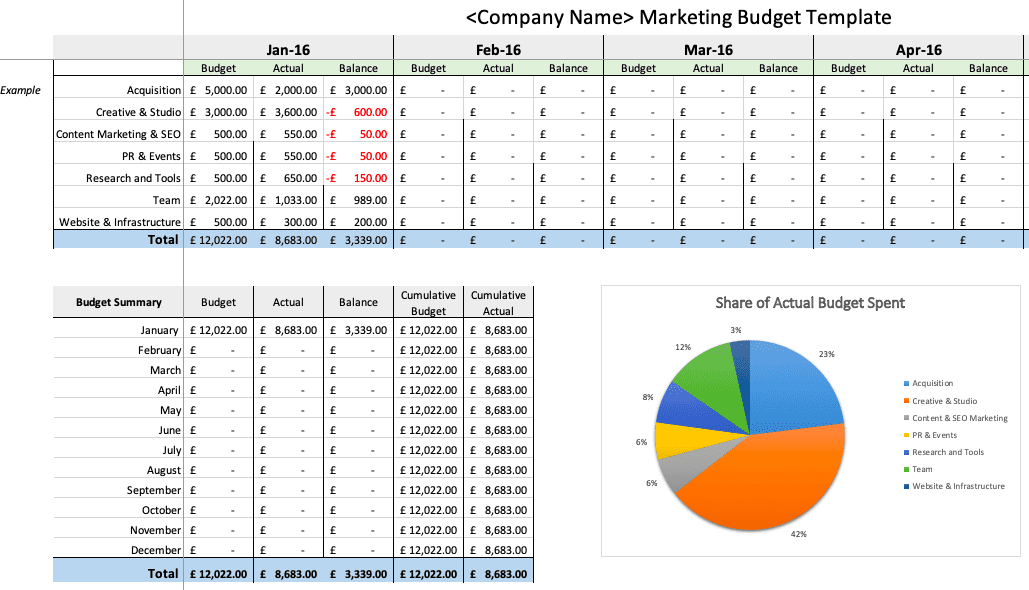

I highly recommend checking out another post on 10 tips on budgeting for teens. Once you learn from that, be sure to see our Spreadsheet for Monthly Budgeting.

3. Find ways to cut your expenses

At first, it always seems hard to find ways to cut your spending, but once you actually realize that there are so many things you can do, it will become a whole lot easier. If you reflect back upon your previous purchases, you think that everything you have bought is fine. But, if you think about it even more, you realize that there is so much money you could save by taking one extra step. In order to get to that realization, here are some tips that will help:

- Use coupons when grocery shopping

- Stick to a limited grocery list

- Unsubscribe from monthly gym or entertainment memberships that you don’t use

- Don’t eat out that often

- Avoid the mall

- Turn off the lights

- Turn off the TV

- Go to the library!

4. Set savings goals

“One of the best ways to save money is to set a goal. Start by thinking of what you might want to save for—perhaps you’re getting married, planning a vacation or saving for retirement. Then figure out how much money you’ll need and how long it might take you to save it.

Here are some examples of short- and long-term goals:

Short-term (1–3 years)

- Emergency fund (3–9 months

of living expenses, just in case) - Vacation

- Down payment for a car

Long-term (4+ years)

- Down payment on a home or a

remodeling project - Your child’s education

- Retirement

If you’re saving for retirement or your child’s education, consider putting that money into an investment account such as an IRA or 529 plan. While investments come with risks and can lose money, they also create the opportunity for growth when the market grows, and could be appropriate if you plan for an event far in advance.” (https://bettermoneyhabits.bankofamerica.com)

5. Avoid debt

Monthly debt payments are the biggest money suck when it comes to saving. Debt robs you of your income! So, it’s about time you get rid of that debt. The fastest way to pay off debt is with the debt snowball method. This is where you pay off your debts in order from smallest to largest. Sounds kind of intense, right? Don’t worry, it’s more about behavior change than numbers. Once your income is freed up, you can finally use it to make progress toward your savings goals.

https://www.daveramsey.com/blog/the-secret-to-saving-money

6. Create an extra income

“According to a recent survey, 35% of Americans say lack of income is the main reason they aren’t saving money. So If you’re already living frugally but are struggling to save, here are some easy ways to add income without adding too much work:

- Sell your extra stuff

- Rent out an extra room

- Sell your parking spot

- Trade gigs with a neighbor

- Monetize your passion

- Work at your favorite place

- Sign up for cashback offers

- Pet-sit”

7. Master the 30-day rule

Avoiding instant gratification is one of the most important rules of personal finance, and waiting 30 days to decide on a purchase is an excellent way to implement that rule. Quite often, after a month has passed, you’ll find that the urge to buy has passed as well, and you’ll have saved yourself some money simply by waiting. If you’re on the fence about a purchase anyway, waiting a while can give you a better perspective on whether it’s truly worth the money.

https://www.thesimpledollar.com/save-money/little-steps-100-great-tips-for-saving-money-for-those-just-getting-started/

8. Learn to negotiate

I can hear my mom now, “If you don’t ask, you’ll never know.”

She was right. And this tip has saved me thousands of dollars and counting. You can approach it two ways:

- Proactively

- Reactively

Proactively: Call the customer service department of a vendor you make regular payments to such as cable TV, cell phone carriers, or trash service. Thank them for their wonderful service and then … ask for a discount.

It’ll take five minutes. One five-minute phone call can result in a years of savings.

Reactively: Let me preface by saying this is not an attempt to get out paying for a service you most certainly owe money for. If you requested a service and you are happy with the result, pay your bill.

With that out of the way, we have all received a bill that caught us off guard. Yesterday, my wife received a bill in the mail for a test she agreed to have done. To her surprise, insurance did not cover it and she was billed $500.

My wife wanted to pay the bill and move on. I asked her to call and politely ask for a discount.

The result? They took $300 off!

How many times have you neglected to make a quick phone call because you were too busy? You might be missing out on hundreds – or even thousands – of dollars.

9. Make your own when you can

If you think about it, there are so many opportunities where you could have saved money by making or fixing something on your own. Instead of buying a gift from a store, you could have hand-made a present. Instead of calling someone to fix the kitchen sink, you could have fixed it yourself. And, instead of buying bread from the grocery store, you could have made it yourself in your very own kitchen!

You can save so much money by being productive and getting stuff done!

10. Always keep looking ahead and never give up

“Don’t let the mistakes of your past drag you down into more mistakes. Instead, look ahead to the future. Learn to see past mistakes for what they are – lessons that were meant to teach you something. Sometimes the best life lessons are learned through life experience, good or bad, so embrace your past and don’t run from it. Promising to do better and setting goals can help keep mistakes where they belong – in the past.” (www.thesimpledollar.com)

For example, if you made a mistake with your finances before, don’t get discouraged by that. Instead, take that as a way to learn to be in control of your finances and not make that mistake again. There will always be times where you make a financial mistake that may cost you a lot, but by learning from it, you can ensure that that mistake won’t be repeated again!

The Takeaway

Saving money is no doubt a necessity to be able to buy essential things and be able to live comfortably. Need to buy a house? Start saving! Want to buy a car? Start saving? Need to pay for college? Save money! I don’t mean to say that money buys everything in life, but it certainly does buy things that allow us to do things more easily and enjoy more. But, the only way you can get a hold of those things is by saving money.

If you have a job and are earning plenty of money, but end up spending it on other nonessential products, you are not left with much money in your hands. Instead, you are left with products lying around you which you may not even use. Those products don’t buy a house or car, don’t pay for education, and don’t let you be able to purchase necessary items. Money does. So, the earlier you start saving, the better it is for you in the long run.

The simple ways to save money listed in this article include:

- Record your expenses

- Create a budget plan

- Find ways to cut your expenses

- Set savings goals

- Avoid debt

- Create an extra income

- Master the 30-day rule

- Learn to negotiate

- Make your own whenever you can

- Always keep looking ahead and never give up

However, with all the temptations in the world today, fancy cars, designer clothes, huge houses, and more, it becomes hard to be able to control the money we have in our hands. Slowly, the money disappears and leaves you with a burden of debt, leaving you thinking, Where did all my money go? Take a look around you- that’s where it went!

Because saving money is hard, especially as teenagers, it is important to know ways and things you can do to save money. This post was all about simple ways to save money, so that you can be motivated to actually start saving and not back off. For more help, definitely check out this video on a simple trick on how to save up a lot of money fast. Also, buy the book: Money Hacks: 275+ Ways to Decrease Spending, Increase Savings, and Make your Money Work for You! Let us know if these tips helped you! Good luck saving money, and all the best for the future!