Welcome to this blog on personal finance tips for teens!

Hello Teen Financial Freedom! I’m Ali Walker from the blog All Options Considered. My wife and I reached our financial independence goal in 2017 and retired in 2018, when I was 44 years old.

In an ideal world teens would learn as much as possible about personal finance from their family and from their teachers in school, and then they would go off into the world of adulthood ready for financial success. But not every parent has personal finance lessons to share with their kids, and only about half of the states in the US offer some aspect personal finance education in high school curriculum (even in those cases personal finance is usually only mentioned within another course rather than taught as a standalone course). There simply isn’t enough personal finance education in our system today, which is why personal finance blogs like Teen Financial Freedom are so important. Spreading financial information is a good thing, and supporting young people in creating their own DIY financial education is really important!

My wife and I like to encourage people to be their own CEO and CFO. It’s exciting to watch young people develop their own interests and find their own paths in life, and we especially love watching our nieces and nephews who are in that same process today. Personal finance related content at all levels is out on the internet for people of all ages to find, breaking the barriers past generations have dealt with in their own paths to financial literacy. Teens today are incredibly well informed, probably more well informed than many adults. The most important thing we can do as adults in the personal finance community is to keep trying to inspire and empower young people.

People have a better chance of finding their own version of success if they learn about personal finance while they’re still young. That includes managing money, controlling spending, saving as much as possible, investing as much as possible, avoiding damaging types of debt, using credit cards responsibly, and planning for retirement. You can never be too young to learn about money and retirement!

Some Basics

The topics in this section might seem like basics for a lot of teens since they are repeated in so many blogs, books, and podcasts. But don’t skip over them — these ideas form a baseline for learning how to manage your money.

Checking and Savings Accounts

Open a checking account for your regular spending needs, and a savings account for your infrequent spending wants. If you have any money at all, even if it’s just allowance and gifts from family, it’s a good idea to have these basic accounts and start learning about them as a teen.

Checking accounts are great for things you want to buy right now, and ATM cards are easier to deal with than cash. It helps to keep a buffer in your checking account that you don’t touch, just to make sure your account is never overdrawn. Some teens might use a $20 buffer, and others might use $100 or more. Your buffer doesn’t need to be very big if you’re a teen without many expenses. Come up with a number that works for you and learn to keep that buffer in your checking account as a safety cushion (pretend it’s not there and don’t spend it!).

Having a savings account is especially important as you learn how to pay yourself first, and earning interest on money in your savings account is a nice bonus to capitalize on. Having a savings account is also a way to invest in yourself with no risk.

Once you have your own checking and savings accounts you have the beginnings of an investment portfolio to keep building on throughout your life. Building a portfolio of accounts is like hiring a team of money characters to work for you and you reach your hopes and dreams.

Budgets

As soon as you’re spending your own money you can start building a basic budget. If you’re a teen you might not have much to list on your budget and that’s ok. Make a list of everything you need or want to buy over the next month, or the next year, and put all of that in your budget. Over time as your budget starts getting more detailed you can organize different budget items into categories, like fun/entertainment or food/groceries/restaurants.

It makes sense to prioritize needs over wants, but don’t get caught up in thinking that needs are important and wants are not. They are both important to your happiness and your success, so it’s helpful to learn how to balance your spending habits with both needs and wants in a budget. The goal is to get used to tracking your spending while you’re young and your spending is more simple so you maintain an awareness of where your money is going as your spending changes over time. Any spending you do is worth tracking and including in your budget. If you pay for food or games that’s worth including in your budget. If you pay for a cell phone bill, video games, or a subscription to Netflix you that’s definitely worth including in your budget. Two of our nieces have a budget category for travel, one of our nieces and one of our nephews each have budget categories for music including lessons and attending shows, and they all have budget categories for food including restaurants and groceries.

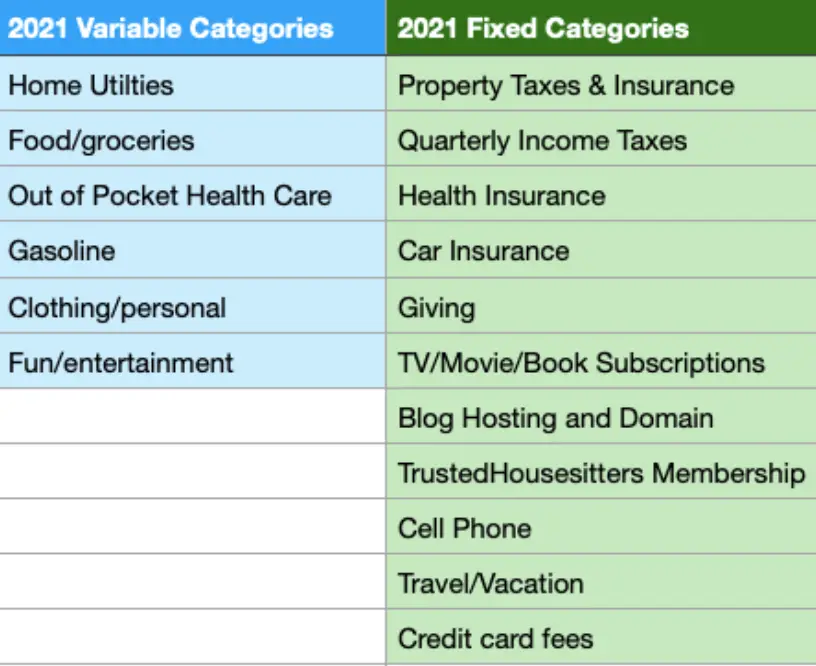

A lot of people seem to hate budgeting, but don’t get caught up in that. Just think of budgeting like it’s brushing your teeth, that’s not a favorite activity for most people but it’s important to do every day. Budgeting really is a self care activity. But it really doesn’t have to be time consuming or complicated, just look for ways to make budgeting fun and get in the habit while you’re young. Our budget categories are listed below as an example.

Spending

The main reason why it’s important to be mindful of your spending is that your spending is connected to every other part of your personal finances. People who have unhealthy spending behaviors tend to have a harder time managing their money and reaching their financial goals. And people who spend money because they see other people spending, or because they feel pressure to buy things so they appear happy or wealthy, can easily find their spending habits are getting out of control. The less you spend, the more you can save, and saving money is the key to reaching the rest of your financial goals. If you can avoid overspending you can avoid negative account balances and overdraft fees. And if you don’t overspend it will be much easier to grow your net worth so you can afford the life you want now, and also live comfortably when you retire.

Credit Cards

Don’t be afraid of credit cards. And don’t over do it by getting a ton of cards and maxing them out. A lot of colleges allow credit card companies to troll their campuses encouraging teens to sign up for credit cards — just keep walking when you see them offering you free swag if you sign up. When it’s time for you to live independently it’s really helpful to have one credit card that gives you something in addition to easy purchasing, so consider a card that offers you something extra like cash back or travel rewards. Getting a credit card will also help you start building a high credit score, something you’ll need to keep your interest rates low and for things like getting approved for your first apartment. Just remember the main rule to follow with credit cards — don’t charge anything to your credit card that you can’t pay off completely that same month. Do your best to avoid paying interest or fees, and pay your credit card balance in full every month.

Bills

Get in the habit of regular bill paying as soon as you have your first bill. A cell phone bill is often the first bill for young people. Get in the habit of tracking all of your bills and their timing, and build a schedule for paying your bills on time or early. And do your best to pay your bills in full eery time, don’t just make minimum payments because that’s when balances can start growing very quickly due to high interest rates. Paying your bills as soon as you get them is a good way to avoid interest, and it comes with a bonus because it feels good to be debt free.

Set Goals

Setting financial goals is an important step in managing your money. If you borrow ideas for goals from other people, take an extra look and make sure your goals really are your own. Categorize your financial goals as either needs or wants, and look at them rationally. We all have our own unique hopes and dreams so spend some time each month setting or reviewing your near term, medium term, and long term financial goals. Maybe you want to buy something that will help you accomplish tasks more easily, or maybe you want to get hired as a volunteer or employee, or maybe you want to learn about low cost index funds, or maybe you want to invest in a Roth IRA. Set a goal, think about the first step and then the next step to achieving it, and give each goal a realistic timeline.

Student Loans

If you plan to go to college, do your best to avoid building a lot of student loan debt. Using student loans to get through college is pretty common and isn’t necessarily a bad thing.

It’s true that student loans can be considered “good debt” since the idea is that you would borrow that money for the purpose of buying a college degree that will help you start a career and earn more money. And once you have that degree and that future career you can start repaying your loans.

But when interest starts building and loan payments are due that can really cut away at your early income and make spending and saving hard. So do your best to graduate with as little student loan debt as possible. If people are paying off student loans every month for years when they’re still in their 20’s, they can’t save or invest as much.

But at the same time know that even though student loan debt might slow you down it’s not necessarily a game changer if you stay on top of it. There are plenty of examples of people who had student loan debt and still reached all of their personal finance goals.

Some Next Level Stuff

The ideas in this list are not as commonly offered to teens, but they are just as important to learn about.

PLAN FOR RETIREMENT!

Open a Roth IRA as early as possible in your life. If you’re under 18 you would open a custodial Roth with a parent or other family member and when you turn 18 you won’t need a custodian any longer. Save $100 (or more) and then tell your parents you want to open a Roth IRA account and your first $100 can be deposited to get the ball rolling. You can also start telling family members you’d love to receive gifts directly in your Roth (we do that for some of our nieces and nephews).

As for which type of fund to invest in within your Roth, everyone has their own preferences and that’s a good thing. Personally, If I could go back in time I would skip individual stocks and other investment vehicles that are full of drama and wild swings. I would invest in an S&P 500 index fund right from the start. Index funds are a great option because they allow you to invest with greater diversification and lower risk at a low price. But do your research and decide what you want to start with.

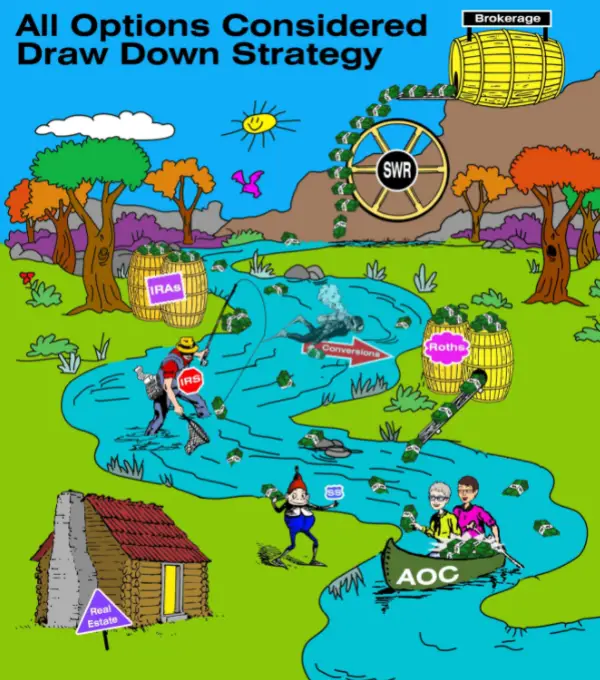

You can open your Roth with a discount investment company like Fidelity, Charles Schwab, TD Ameritrade, or Vanguard (these really are equally good options). Pick what works for you. The goal is to capitalize on compounding growth from the stock market in a tax free account when you’re very young, and then let that money compound over decades. Then when you’re 59.5 years old you’ll have full access to that account, full of tax free money to help cover your needs at that stage in your life. Being 60 years old may seem like it’s a million years away, but do yourself a favor and get started while you’re young. Then when you’re ready you can start designing your draw down strategy like ours illustrated in the cartoon below.

Financial Literacy

Focus on financial literacy! Set a goal to learn everything you can about money and personal finance. You’ll notice that finance professionals sometimes use terms the rest of us don’t normally use, so just keep learning and look up any terms you aren’t familiar with. And make sure you cross check everything with an educational source that isn’t selling financial services (my favorite is Investopedia.com).

Every time you come up with a personal finance topic that you don’t understand, add it to a list and keep learning. If you make learning about personal finance a habit when you’re a teen you can learn more about money before you’re 30 than many adults from previous generations learned in their lifetimes. Money and investing used to be topics that only a privileged few really understood but those days are over. Teens today are able to find complex financial information online very easily. Learn as much as you can about different types of accounts, and different investment options and asset types. Read books and blogs, listen to podcasts, and take classes in personal finance and investing.

Emotional and Behavioral Finance

People tend to form emotional connections with money, some good and some bad. Young people today can learn to avoid carrying money baggage into adulthood, a huge advantage compared to previous generations. In the same way that emotional stress can complicate all of your relationships with other people, money baggage from shame about financial mistakes can damage your long term financial health. Pause and think for a minute — have you noticed any adults in your life struggling with how they feel about their financial situations? I bet you have. Many (most?) adults today have to battle with feelings like shame, guilt, greed, or pride when they make financial decisions. And on the flip side, sometimes you’ll notice that people have an adoration for certain characters or ideas in personal finance, and that’s not healthy either. Avoid getting caught up in that kind of hype and make sure you don’t follow any person, advice, or idea blindly. Gather personal finance content from as many sources as possible and be willing to disregard “the experts” too.

Money is a tool and good financial decisions are based on what’s reasonable or rational in your situation. But everyone makes mistakes. So make your mistakes, learn from them, make better decisions next time, and then let those mistakes go. If you can start building a healthy relationship with money when you’re still a teen, and learn how and why money baggage can weigh people down, you’ll be able to make better financial decisions throughout your life.

Build Your Money Team

Build a diverse personal finance community of people to learn from and share ideas with. Make sure you’re learning from more than just your parents, and definitely more than just traditional personal finance managers and advisors. Take advice with a grain of salt if that information comes with a sales commission and focus on what’s best for you.

Build your own money team and keep adding to it. Talk to as many people about money as possible. That can include your family, your classmates, your colleagues, people that are your age and also people from other generations, people who look like you and people who don’t look like you, people from other parts of the USA, and people from other countries as well. Today’s personal finance community is global and very diverse so there are lots of people out there for you to connect with.

Thanks for reading this post!

If you want to chat you can reach me through our blog All Options Considered. My wife and I blog about life and personal finance, and we always like to meet new people and share ideas. We are not certified financial professionals or experts, and we’re not selling anything. We’re just regular early retirees sharing information and supporting others as they follow their own paths.