Welcome to this post about my automated financial system in 2022!

So about a year ago, I was reading I Will Teach You To Be Rich by Ramit Sethi. I loved a lot of things about the book, but one of the main takeaways that I had was when he talked about automating your financial system.

I had wanted to set this up for the longest time, but never got around to it. Part of it was because I was waiting to turn 18 so that I can open a new bank account. But, I also procrastinated even after I turned 18 for a few months.

In January I finally started setting it up and it was all ready to go by February. I’ve been monitoring the system throughout this month to make sure it is successful. The last automated transaction went through the other day, so I feel like the system is successful enough to write a post about it now.

So let’s get into it!

I Will Teach You To Be Rich Philosophy

First things first, I want to give credit where credit is due. I Will Teach You To Be Rich (IWTYTBR) was the book that introduced this idea to me. I probably wouldn’t have set this up for several years unless I read that book.

The book takes a different approach to personal finance than some gurus. IWTYTBR is about a simple and easy journey you can take “to be rich”. I would say that most of the concepts are for beginners, but there are plenty of advanced concepts in there as well.

Sethi suggests you focus on the big wins, and don’t worry about the small things. For example, if you manage to save hundreds of dollars on your car payment, don’t worry about spending a few dollars here and there on a coffee.

He argues that you should spend your money on things that matter to you. So if you love coffee, then buy coffee. But, don’t spend money on things that don’t add value to your life. After all, what’s the point of accumulating all of this money if you never spend it?

He also doesn’t want people to live in financial spreadsheets. He believes you should set things up, then move on. Regular checkups are a good idea, but once a month is really all you need.

Overall, IWTYTBR’s philosophies are a good start and will be massively beneficial to most people. But, once you have a good financial foundation going, you can take it a lot further than this book suggests.

Ramit Sethi’s Automated Financial System

Sethi uses the following example throughout his book to showcase what an automated financial system can look like.

Sethi’s example system starts with 5% of his salary being contributed to his 401k before he ever sees the money.

The rest of the money shows up in his checking account a few days later. That is when another 5% is contributed to his Roth IRA and another 5% into savings.

The remaining 85% is used to pay off all bills that are put on credit cards and any other miscellaneous expenses.

Whatever money is leftover in your checking account after you have paid all of your bills is yours to spend, guilt-free.

Pro’s of Sethi’s System

What I like about this system is that it is based on a pay-yourself-first model. Before he spends any money, he is saving and investing 15% of his money.

After his bills are paid, he can spend the remaining money because he knows that his savings and investments are already taken care of.

I also like the fact that this system is automated and simple. Each month, his money is moved around to where it needs to be with only a few transactions.

Con’s of Sethi’s System

What I don’t like about this system is the fact that only 15% is saved and invested. While this is a great start, many people can go beyond this.

I also don’t like the idea of guilt-free spending. I believe that after your expenses are covered, the remaining money should be swept away into savings or investments. This is a great way to spend less and accelerate your wealth building.

My Automated Financial System

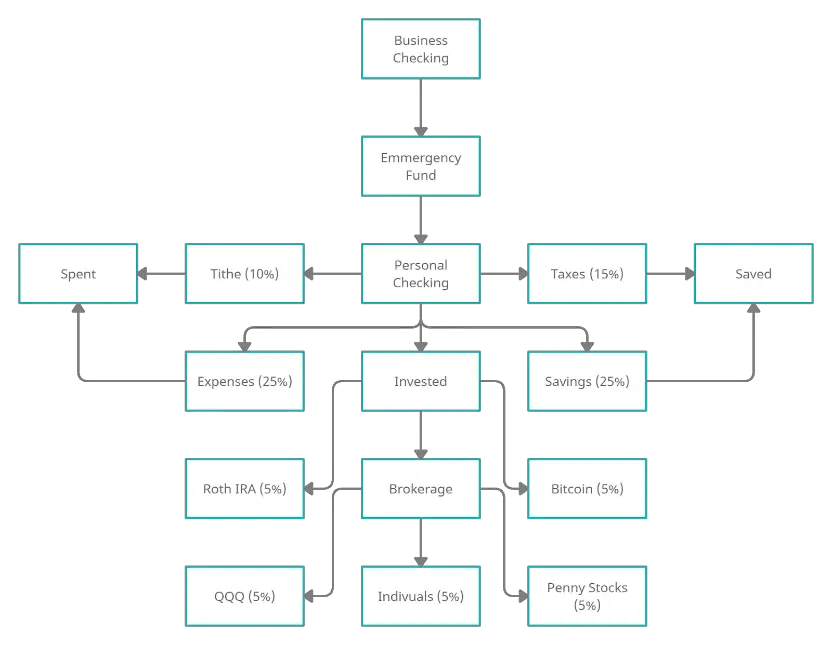

With that in mind, here is how I ended up structuring my financial system:

As you can see, my financial system is a lot more complicated than Sethi’s was, but I’ll do my best to explain it.

The Reasoning Behind My System

My system needed to have a few extra capabilities that Sethi’s didn’t offer. The first of which is a business checking account. As a freelancer and entrepreneur, I have a lot of money coming in and out that I like to keep separate from my personal checking.

My system also has an emergency fund built into it. At any given time, there should be enough money in that account to cover 6 months worth of income.

I don’t have any taxes withheld from my self-employment earnings, so I have to be able to save for that as well.

Lastly, I wanted to save and invest a lot more than just 15%, so my percentages reflect that.

The Percentages

25% Non-Negotiables – 25% of my money goes to non-negotiable items. 10% of which is tithed to my local church. The other 15% is money that I set aside to make quarterly tax payments.

25% Saved – 25% of my money gets saved in my savings account. Not much else to explain about this one.

25% Invested – 25% of my money gets invested in one way or another. 5% goes to my Roth IRA, 5% goes to a tech ETF, 5% goes into induvial stocks, 5% goes into penny stocks, and 5% goes into Bitcoin.

25% Expenses – 25% of my money gets spent on my expenses. Things like car repairs, food, gas, gifts, games, technology, etc.

The Timeline

Here’s how it all breaks down in terms of timing:

1st of the Month – A transfer goes from my emergency fund to my personal checking account which is 100% of my “income”.

5th of the Month – 10% of that income is tithed directly to my church.

5th of the Month – 15% is sent to my savings account set aside as money I’ll spend on quarterly tax payments.

10th of the Month – 25% is sent again to my savings account as general savings.

15th of the Month – 15% is sent to my brokerage account which will be used later.

15th of the Month – 5% is sent to my Roth IRA which will be used later.

15th of the Month – 5% is used to purchase Bitcoin.

30th of the Month – I transfer everything above a certain threshold (buffer) from my Business Checking to my emergency fund.

30th of the Month – I transfer everything above a certain threshold (buffer) from my Personal Checking to savings.

30th of the Month – I use the money set aside in investment accounts to actually go make investments (Roth, individual stocks, penny stocks).

Things I Like About My Automated Financial System

Pays Priorities First – My system is also based on a pay-yourself-first model. The first thing that I do is tithe and set aside money for taxes, which are my biggest priorities. Then, I save and invest my money. By the 15th of the month, I am free to spend money on other expenses because my savings are investments are taken care of. At the end of the month, I save everything that I didn’t spend.

Buffers – As mentioned, I do have buffers in each account to cover any mistakes that happen. In the event that a transfer doesn’t go through, I should have other money to cover my expenses immediately. Then, when I go do my monthly review, I can fix any mistakes that happened.

Leaving A Few Days In Between Transactions – To try to avoid any mistakes, I left a few days in between automatic transfers to make sure there’s plenty of time for things to get corrected. Even on a long weekend or a holiday, there’s at least 5 days between one set of transfers and the next.

The System is Automatic – I love that this system is very automatic. All of the transfers I mentioned were automatic, recurring transfers that will happen every month. There are only a few parts that aren’t automatic. You can use these apps to automate your savings and make your money-saving goals more convenient for you.

Monthly Review – For the parts that aren’t automatic, I take care of them on the 30th of the month during my monthly review. This is when I transfer extra money from different accounts and also when I make investments with money that is in investment accounts waiting to be invested.

Money is Saved, Spent, or Invested

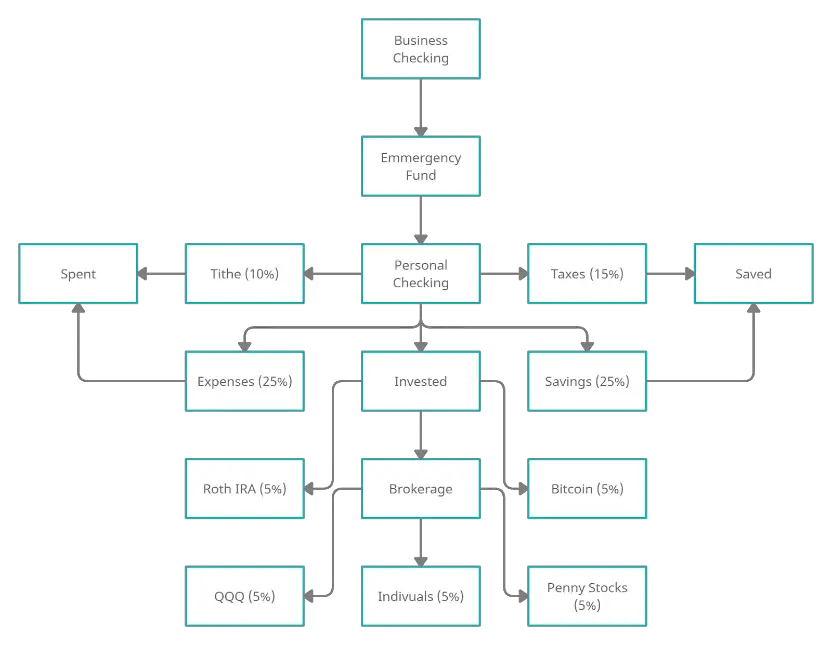

After reading those last few sections, here’s a look at my automated financial system again.

If you look closely, you’ll notice that money only does a few things. Money is either saved, spent, or invested.

It might seem kind of obvious, but I think it is important to mention that these are the options you have when devloping your own system.

Ideally, you want to maximize the amount that is saved and invested and minimize the amount that is spent.

Steps To Take To Set Up Your Financial System

Plan Your System

The first thing that you need to do is plan your financial system. I would start by reviewing your income and expenses from last year. These will give up a pretty good idea of how much you’ll make this year and how much you’ll spend.

You want to setup a realistic budget with a few improvements from last year’s spending. Figure out what is a good amount for you to save and invest. Also start planning what you are going to invest in. Here are some investment ideas.

It might also be helpful to draw out your system like I did. I used a website called Creately to draw the diagram I showed earlier. It’s nice to see big picture what is happening within your system.

Setup Bank Accounts

The next thing you’ll want to do is setup the bank accounts you’ll use for your system. It’s quite possible that you already have a bank account, but you might want a new one to start fresh.

I created an account on Charles Schwab to setup my system. The thing I liked about Schwab is that I can have all my financial accounts under one login on the same app. I’m talking checking, saving, brokerage, Roth, etc. Internal transfers are super easy and typically go through immediately.

Setup Recurring Transfers

The last thing you’ll want to do is actually setup your recurring transfers. Almost every bank out there allows you to do this. It just might take some research to figure out exactly how.

While you can’t necessarily setup these transfers to run on percentages, you can set them to have a certain amount and go through on a certain day. Go through each step of your system and setup a recurring transfer for each.

Reap The Benefits

The final step is to reap the benefits! If everything is done well, your system is now setup and ready to go. Your transfers should start going through next month and it is a good idea to monitor them closely for the first month to make sure everything goes smoothly. After the first month, you can rest assured everything should be functioning well.

The Takeaway

That’s it! There’s how you can setup an automated financial system. Once again, I’d recommend you check out I Will Teach You To Be Rich by Ramit Sethi. That book has a lot of great tips and helped me setup my own system. To recap, an automated financial system is a simple and easy way to manage your finances. It is a set of recurring transfers you can setup to move money around, save and invest, and pay off bills automatically. Once setup, you can reap the benefits for years to come. Let me know if you have any comments, questions, or other thoughts down below. Otherwise, best of luck setting up your own system!