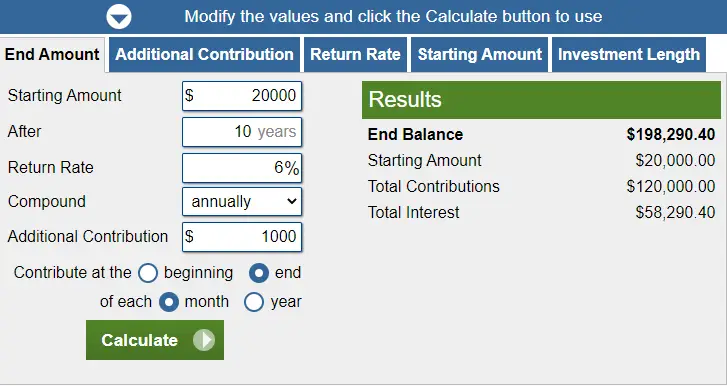

Below is one of my personal favorite finance tools… An investment calculator! The power of compound interest is absolutely incredible, and one of the easiest ways to see it in action is by projecting your investments with a calculator like the one provided here.

So let’s begin!

Investment Calculator

The best investment calculator that we have found at Teen Financial Freedom is this one right here:

https://www.calculator.net/investment-calculator.html

What Is Investing?

It might seem a little silly having to explain what investing is, but it does help to break it down every once in a while (the world of finance can easily be confusing to the ones just entering it!).

Investing is a pretty broad term. For example, you could invest in stocks, bonds, index funds, cryptocurrencies, gold/precious metals, or by buying out a whole business.

No matter the vehicle you use, they all have one thing in common – investing takes the money you put in, and multiplies it (if you invest wisely… If you don’t, you lose money!).

Investing, in a nutshell, is just making your dollars earn more dollars. Instead of going out and trading your time or physical effort at a job to earn $100, you could invest $10 and multiply it into $100 (granted, that’s a significant return on investment, but you get the point, lol).

Benefits of Investing

The benefits are pretty simple. Investing is just wise money management. Money is a necessity in life, and one of the easiest ways to earn it is by getting a job or starting a business. At some point, though, you’ll probably want the freedom of being able to support yourself without a job or being tied down to a business.

Even if you love your work and don’t plan on fully retiring, investing is still a very, very wise decision for a couple reasons:

- As you get older, jobs and an overly active lifestyle will become less desirable.

- You may not be able to work as much as you used to, so having a back-up income to replace your job is critical.

- If all goes well and you invest wisely, you’ll have a significant amount you can pass on to your heirs and be able to leave an amazing legacy.

- Besides benefitting you, investing allows you to help many other people as well. As you accumulate a larger and larger portfolio, and as it starts multiplying rapidly, you’ll have an extraordinary opportunity to bless the people and charities you care about in a huge way.

Investing Examples

Here are a few investing examples demonstrating how differences in time and return on investment can impact your net return dramatically.

Example One:

Leroy (I’m gonna be picking the most random names 😂) got a job right out of college, at the age of 23, earning $50,000 a year. He invests 15% of his income every single year, though his income is constantly growing. At age 35, he’s earning $60,000 a year. At age 45, he’s earning $75,000 a year. Even though he was financially able to retire at age 52, because he hit his FI number of $1,250,000, he decided to keep working a few more years.

He finally decides to retire and start traveling at the age of 60. By this time, his investments have grown to over $2,963,729.31!

This is the Everyday Millionaire style of building wealth. It’s ridiculously simple. Stay out of debt, don’t spend like you’re in congress, and invest consistently in a no-nonsense way for a long period of time, and you’ll be a millionaire.

Example Two:

Kiara, 20 years old, puts $5 every day into her Robinhood account (for easy math, we’ll assume she was investing in index funds and has an average ROI of 10%). By age 65, her portfolio has grown to almost $1.5 million dollars, or $1,450,490.51 to be exact.

Example Three:

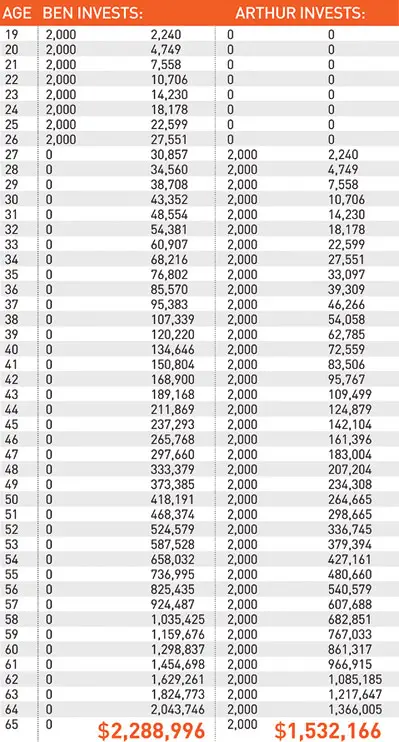

One of the best examples of the power of compound interest is this infographic from Dave Ramsey. I highly recommend giving his short article a read!

The chart above shows that Ben started investing $2,000 a year (or about $167/month) for eight years, and then never puts another dime in. His buddy Arthur waits eight years, and then, starts investing $2,000 every year until the age of 65… but he never catches up with Ben!

That, my friends, is the power of compound interest.

How To Invest More Often

Investing your money does take discipline. Countless people know investing is a wise idea, but constantly put it off, because they’ll do it later “when they have more money to invest.” I’m guilty of this myself.

Hate to break it to ya, but that someday will never come. As you make more and more, you won’t have more leftover to invest, but instead, your spending will very likely increase to match the growth in your income. You have to make the decision to start setting aside money today.

There are two simple tricks I used to overcome putting it off “until a better time.”

First, tax yourself. It’s another way of saying, set aside a certain amount regularly, from all your income. I like the wording “Tax Yourself,” because taxes are non-negotiable, you have to pay them. Investing should have the same level of importance, so using this wording helps me to not talk myself out of it.

There’s really no magic number. Starting with a very low number is FAR better than not starting at all. If all you can spare is 5% of your income, great. Start with that. If you can do 30%, no problem, awesome!! Save it all, don’t lower the number!

Second, put the money you set aside somewhere you can’t see. I know from painful personal experience that putting your stash of cash into a savings account right next to your checking account does not work. I would save $100, see it sitting there in my savings account just a tap away, and then, I’d cave and spend it.

Since I started transferring my savings to a savings account separate from my main bank, or straight to my investment account itself, I have had a lot more success in not spending it.

Interestingly enough, when you move your savings out of sight, you tend to forget it’s even there!

Investing Apps

Utilize technology! Investing software is absolutely mind-blowing nowadays. There is no shortage of extremely cheap, or even free, investing services that can have an incredible impact on your success. Here are some of my favorite apps and services:

Ninja Savings (round up savings):

Cash Back:

- Dosh: Just connect your debit card, spend, and boom! Cash back.

- Paribus: Alerts you if an item you just bought drops in price and will refund you the savings. 100% free to use!

- Bumped: Very similar idea to Dosh but instead of giving you cash back, it awards you with stocks! Unfortunately, there is a waiting list at the moment.

Money Goals and Saving Apps:

- Qapital: Goal setting for your finances. Fees range from $3/month to $12/month.

- Dobot: Very similar to Qapital, but you also get your own little AI or “Bot” who can automatically save for you. Best, of all, Dobot is FREE!

Investing Accounts:

- Robinhood: Definitely a favorite of mine with their mostly fee-free investing, but you do have to be 18 or older. Here’s their full list of fees.

- Webull: Similar in many aspects to Robinhood, yet it does offer a couple more robust tools and options for investing. We also have a super cool affiliate deal with them where if you sign up and deposit $100, you get some free stocks! 🙂

- Stockpile: HIGHLY recommend this for any parents out there wanting to give their kids access to investing in a simple, and basically free, way. Their only fee is a $0.99 per trade commission.

The Takeaway

Investing, and specifically compound interest, is an extremely powerful wealth building tool. I encourage you to use the calculator above to play around with different scenarios, and see how crazy compound interest can be! Investing is very simple – you are just making your dollars earn more dollars, and then all of that money is earning even more money, and then all of that money is earning even more on itself!

Investing takes discipline, and it’s not the easiest thing in the world to learn. It is absolutely worth the effort though. Be sure to check out: Investing QuickStart Guide: The Simplified Beginner’s Guide to Successfully Navigating the Stock Market, Growing Your Wealth & Creating a Secure Financial Future.

Also, if you liked this calculator, try checking out this Financial Independence calculator! Jacob did an excellent job of explaining the FI/RE movement, and I highly recommend you check out his post. Best of luck on your investment journey!

Random Side Note:

Ever wondered what a million dollars looks like? Well here you go! 🤑