Welcome to Important Real-Life Lessons About Money During COVID-19!

Let’s face it. The vast amount of Americans today who are financially illiterate is a scary statistic to look at, and even a scary reality to live in.

44% of Americans don’t have enough cash in their savings accounts to cover a $400 emergency. Can you imagine?! Think about those who live in underdeveloped countries, what about them?

Now, with COVID-19 at large, the unemployment rates higher than ever and the alarming amount of panic in the world of consumerism, how do you think these families are now reacting?

You either fall into or between the two types of people during this crisis. One is that you are fearful and angry, you might feel scared and unsure how you are going to survive financially. If you are this individual, you are living in survival, fear-based mindset.

Or you could look at the world as it is, take everything in, and look for the opportunities that this pandemic may do to you. One of these blessings might be more time for you to spend on your business or spend with family! Whatever it may be, you might not seem quite bothered at all.

Lastly, you can be a mix of in-between. You can see the opportunities of what this situation can do for you, yet you are worried or you don’t know where to start because of all these excuses you tell yourself that you can and can’t do. You might be afraid to take massive action.

Whatever the situation may be for you, the first step is not to worry. I know, it sounds like very generic advice, but stick with me here.

You don’t want to overwhelm yourself more at such a critical time. You already lost the job, you might be losing a family member or friend, you don’t know how you will ever pay the bills, and on top of that… You’re overwhelming your mind with possible negative scenarios as to why you won’t be able to make it.

STOP, nothing is more self destructing than that.

Even if you have the virus, are you going to let it kill you and everything around you? No! You should fight back! This should not be the defining moment when you have to give up. Let this be your epiphany or your calling. Don’t let your environment control you. YOU, and only you, have the power of what you allow in your life, and it all starts with a positive mindset.

You are either a leader or a follower. Now you choose a side! Are you just waiting for the government to finally do something? Or are you going to make that radical change in your life and take lead?

You should fight for your family, not whine and complain about why it can’t work for your family.

Financial illiteracy is currently the #1 economical problem in the world, yet the stress on learning about personal finances is not massively supported in our schools and institutions.

Sure, there may be some classes for finances and accounting, but to what extent does their curriculum help you in any way? Colleges teach about business through a textbook written 20 or 30 years ago. I mean, they might change the editions of the same book, am I right?

But the world is changing and simply, these strategies cannot be applied through a textbook that may be outdated, especially prior to the internet era. It seems that we cannot beat the rate at which we are evolving. Some may argue that even Google is all you need to find all kinds of current and updated information.

The system is going to school, learning about something that we may or may not even use, and instead, we learn these financial mistakes through experiences when we get an enormous amount of debt, we file for bankruptcy, we lose our significant others and everything else goes terribly.

Start asking yourself, why is there such a gap between those who are fearful and those who aren’t at difficult times?

Why is there such a gap between the financially literate and those who are financially illiterate? There is a mindset gap.

Politics aside, I want you to be open-minded. No matter which side you are on, either that of socialism or capitalism, I ask you to think like a capitalist.

Not all capitalists are greedy. There is a misconception that if you are money-driven, that you are selfish. Forget about that for now. Think as to why capitalists value the importance of money and financial literacy.

To start us off, the main concepts and ideas that are discussed throughout this post are directly from the book How Money Works: Stop Being a Sucker by Tom Mathews and Steve Siebold.

This is not an advertisement to buy the book, although I do highly recommend reading it. It explains money concepts with pictures and diagrams that are easy to follow through. It has everything you need to “stop being a sucker”.

My sole intention is to convey some important principles about money, and How Money Works: Stop Being a Sucker explains just that.

Concept #1: Power of Compound Interest

What is compound interest? Well, as one of the people interviewed people in this book says, “it’s like interest on interest”.

Reality is, guys, not a whole lot of people know about investment vehicles that will compound their money at such high interests over time.

Most families will save their money in the bank with more or less than 1% on an interest rate. This means, according to the rule of 72, your money will double in about 72 years. It sounds like a great investment, right? You might feel my sarcastic remark, but that’s reality.

Not a whole lot of people know where to invest or keep their money in because they chose not to learn these concepts. Instead, they learn through their mistakes. This is the average way of doing it. The average person does not know the importance of knowing how money works.

Although I might be calling you or anyone you know of out, it doesn’t matter. You or these people do not know how to leverage money so it can work for you.

If you find an investment or savings vehicle with an interest rate of 4%, your money will double in about 20 years! What if I tell you that there are vehicles out there you can leverage your money for more than 12%?! This means that your money doubles every 6 years!

Imagine putting 100k in an investment account in which has an interest rate of 12%! The compound power of that is crazy! That is how the rich get richer, and the poor get poorer.

Concept #2: Time Value of Money

The time value of money has to do with receiving two identical sums either now or later.

Let’s say someone is offering you $100 now, or $100 a year from now. On the surface, the amount of money you get seems to be the same, in this case, $100. Now obviously, most people would want the money now. And they’re right, the $100 now is a better decision.

Why? Because if you take the $100 now, you could potentially turn it into $110 by next year. If you play your cards right, the money you have now should be worth a lot more in the future. This is the time value of money. The more time you give your money to grow, the larger the amount will become.

A good example of this is taxes. Most people either owe money or receive money back in the form of a tax return when it’s time to file taxes each year. A lot of people, myself included, are excited about receiving a large sum of money.

No one dislikes receiving more money. But actually, a tax return is sort of bad. This means that the government has been holding on to your money for the last year and now is paying you. Instead, if you would have received that money equally throughout the course of the year, you would have been much better off because of the time value of money. That money could have been invested to generate a much better return.

Essentially, money should generate more money overtime, and that is the time value of money. So if you ever have the choice to get money now or later, always choose now because of the potential earnings capacity.

Concept #3: Rule of 72

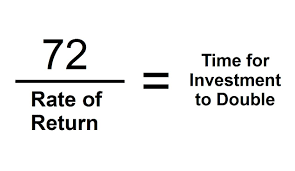

The rule of 72 has been referenced multiple times throughout this post. If you don’t know what it is, it is the basic rule investors use to determine how long it will take to double their money using compound interest.

It is a simple rule. First, you must know your interest rate that you will earn from your investment on average. Then, you divide 72 by your interest rate. The number you get is the number of years until your money doubles.

So if your interest rate is 1%, your money will double every 72 years (72/1).

If your interest rate is 5%, your money will double every 14 years (72/5).

If your interest rate is 10% (stock market average), your money will double every 7 years (72/10).

Finally, if your interest rate is 12%, your money will double every 6 years!

If you somehow manage to pull a 12% rate of return, you’re lucky! Your money will be worth 2x the current value in 6 years, 4x the current value in 12 years, 8x the current value in 18 years, or 128x the current value in 42 years!

How crazy is that!? That is the power of compound interest!

Check out more on this topic in our investing category!

Dave Ramsey’s 7 Baby Steps

Dave Ramsey has a list of 7 items that are the steps towards a successful financial life. While there’s a lot more to do than this, this is a good starting point for a lot of people.

- Save $1,000 for emergencies. Start off by saving this much, but know that you should save much much more in the future!

- Pay off all debt (except the house) using the debt snowball. If you’re unfamiliar with the debt snowball method, this involves paying off your debt in the order from smallest balance to the largest balance, to use the psychological momentum to your advantage.

- Save 3-6 months of expenses in an emergency fund. This is where you expand your savings. But, don’t stop there, once you hit this milestone, continue to get 1 year’s worth of income in cash.

- Invest 15% of your household income in retirement. Now start saving for your retirement. Save at least 15% for your retirement. If you struggle to do that, your road may end here. You have to take care of your retirement before the rest of the steps.

- Save for your children’s college fund. If you are still managing to save 15% for retirement, you can now start saving for your children’s college fund. But make sure you save for your own retirement before you save for your kids.

- Pay off your home early. If you managed to do both of those, then now you can pay off your home early!

- Build wealth and give. If you did all of the above, congrats! You’ve had a successful financial life and now it’s time to build wealth and give.

The Takeaway

Hopefully you learned something valuable in this post. The hope is that you use this pandemic to teach you some lessons about money. If you use the principles described in this post, you’ll be financially independent in no time! COVID-19 or not, you can always learn about money regardless. So, check out the book: The Psychology of Money: Timeless lessons on wealth, greed, and happiness. Best of luck!