Big news y’all! Today, Bloom officially launched with full public access. Bloom offers commission-free investing & education modules. You could literally start your investing journey today, instead of being stuck in analysis paralysis until you’re 30. Let’s take a look at what exactly Bloom is, how to get started investing, and why it’s important to start young.

Why Investing Early Is Important

By far the greatest asset that we have as youth is TIME.

In the investing world, time means everything. One of the biggest regrets I hear from adults when I discuss investing or personal finance with them is they just wish they had started earlier.

Most people put off investing like they would a school paper – wait until the last second. As a teen, many of us think we’ll just let our 20-something-year-old selves “deal with that whole investing thing.” By then, we’re getting busy with college and finding a job.

So then, you push it off into your 30s, but you’re dealing with marriage and kids and maybe even a j-o-b, and right before you hit your 40s, you wake up and realize, “Shoot! Investing was SUPER important to start at a young age… like decades ago.”

I’m grateful I haven’t personally experienced that regret, but from the look on most adults’ faces when they discuss it with me, you don’t want to wait and find out for yourself. Learn from their mistakes and save yourself a world of hurt!

Here’s the key to why investing is so important at a young age:

COMPOUND INTEREST

Compound interest simply means your money earns money. Then, that money also earns money (and so on and so on). A super basic example is this:

Say you start with $100 and invest it at 10%. The first year, you’ll make 10% of your original $100 (which is $10), so you’ll end the year with $110. However, in the second year, you don’t earn $10, but $11 (10% of $110)!

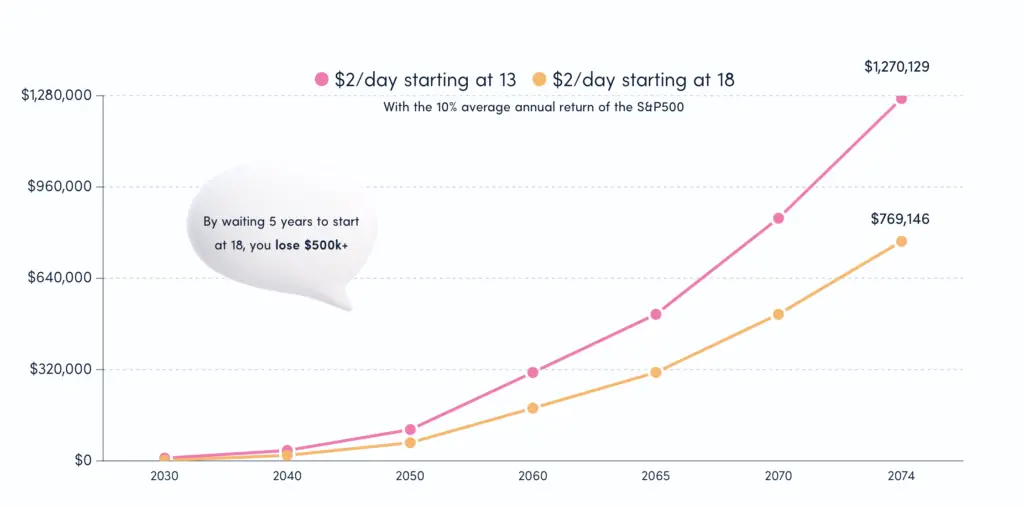

$1 might not sound like a big deal, but that’s where time comes in. Check out this graphic:

That is the power of compound interest. Waiting just five years to start investing dings your portfolio by $500,000 (and if you don’t believe me, here’s a calculator to run the numbers yourself).

Difficulties with Investing Early

For the longest time, the finance world made it very difficult for people to get a head start on their personal finances at a young age. My first investing account took me several days to set up, lots of paperwork and emails, and was, overall, just a massive headache.

To add insult to injury, the software was hard to use, and I accidentally got charged $50 for buying $2 worth of stock when I tried to execute one of my first trades!

There was a need for a simple and safe way to begin one’s finance journey at a young age. A solution without fees, poorly designed software, or dozens of hoops for your parents to jump through as they try to help you get started. A few guys named Sonny, Sam, and Allan set out to solve this exact problem, so they created Bloom.

About Bloom

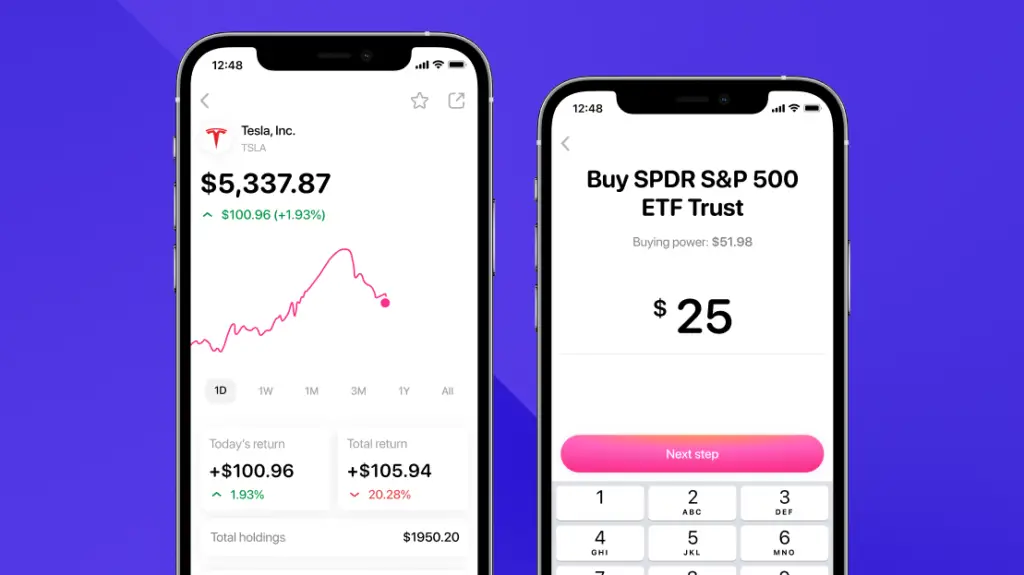

Bloom is a fee-free investing app for teens aged 13-17. It has several educational modules designed to help beginners understand key terms and strategies for investing their money wisely. They also offer fractional investing (the ability to buy parts of stock shares), a news feed, and a “Time Machine” calculator that lets you see how much your investment would have been worth at different times in the past.

How to Get Started

While teens can’t set an account up solely by themselves, Bloom makes it easy to get started. According to US laws and regulations, a minor is required to have a parent or guardian set up their account. If you click the button below you can download the app and start your application. You’ll be prompted to pass it on to a parent or guardian to finish the process by entering their phone number through which they’ll be able to pick up where you left off.

If you have more questions, check out Bloom’s FAQs here.

Wrapping It Up

Investing early is one of the best decisions you could ever make, and Bloom makes capitalizing on that opportunity easier than ever! That’s my favorite thing about Bloom. You don’t have to worry about stacks of paperwork and getting charged ridiculous fees like when I first got started investing at 13-years-old.

Despite myself being 18 and unable to use the app myself, I know several members of the TFF team have already downloaded it and started their own investing journeys! Check it out and let us know what you think! If you have any questions about Bloom or investing drop them in the comments below and I’d be happy to help. 🙂