Welcome to How To Plan Retirement

As teens, we have a long way to go until retirement, but it’s never too early to start thinking about it, especially when it comes to the power of compound interest.

So today, I want to discuss the financial planning aspect of retirement. We’re going to be going over how much you need in retirement, how much you should save each year, and how long it will take you to reach retirement.

I think the best time to start thinking about this stuff is when you’re young, either in your teens or in your 20’s, because the earlier you start saving, the less work you have to do and the more work your money does for you!

So let’s get into it, here is how to plan retirement!

How Much Should I Have For Retirement?

For the purposes of this post, we are going to describe retirement as financial independence. What does that mean?

What that means that your passive income is enough to cover your expenses.

You don’t necessarily have to stop working once you reach financial independence, many choose to keep working. But the idea is that you don’t need to rely on your job as your main source of income.

Therefore, you don’t really need to worry about finances anymore as your passive income is bringing in enough to cover all of your expenses, thus, financial Independence.

Passive Income

So how exactly do you create passive income? Well there are several ways, but here are some of the popular ones:

- Dividend Stocks

- Real Estate

- Business

- Savings Accounts

- Lending

- Investing

And those are just a few, there are so many other ways so I encourage you to research ways to create passive income.

But, for the purpose of this post, we’re going to be talking about stock market investing.

Because, if you manage to invest enough money in the stock market, you can retire!

4% Rule Retirement

You might be asking, well how much do I need to invest in the stock market? The answer is, it depends on the person.

Luckily, there is a rule called the 4% rule that people use to calculate how much they need to retire.

Here’s how it works:

- Figure out what your annual expenses are.

- Multiple that figure by 25.

- This is how much you need to have saved and or invested to retire.

- Once you reach this number, each year you can withdraw 4% of your savings or investments.

The best part of this is, on average the stock market returns 10% per year, meaning, that if you only withdraw 4% and your account grows by 10%, your money should continue to grow long into retirement.

Hopefully you understand the 4% rule retirement plan. If you don’t, I encourage you to do more research, but basically the idea is that you need 25x your annual expenses either saved or invested.

Some people use the 3% rule just because it is more safe. If you want to use this rule, you need to save 33x your annual expenses instead of 25x. And instead of withdrawing 4%, you would only withdraw 3%.

What Is My Retirement Age?

So now that you know how much you need to retire, you’re probably wondering how long it will take you to get there.

Well let’s say that you make $50,000 a year and you manage to cut your expenses to just $30,000 a year, meaning that you are saving $20,000 per year.

So if we follow the 4% rule again, we can see that you’ll need $750,000 to retire ($30,000 x 25).

At this point if you do the math, you might divide $750,000 by the $20,000 a year and see that you will need to save for 37.5 years.

But, that’s not accurate! If you were saving that money in a saving account, than yes, that might be close. But, if you were investing that money instead and allowing it to accumulate compound interest, it would actually take a lot less time.

In this case, if you were investing the money as you go, it would only take 19 years to retire with a 7% interest rate adjusted for inflation.

So obviously you should invest as you go, but also make sure that you are factoring in compound interest into your calculations.

There are plenty of investment calculators out there that do this for you. Here’s a link to my favorite investment calculator.

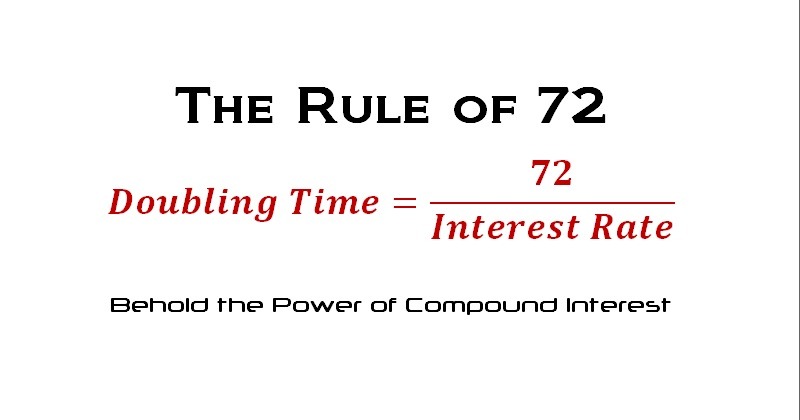

Rule of 72

If for whatever reason in the future you don’t have an investment calculator available in the future, you can always use the the Rule of 72.

This rule is very simple and is one of the core investing principles.

Here it is:

Divide 72 by your average annual interest rate on your investment, the number that you get is the number of years it will take for your money to double.

So if you invest $100 in a fund that generates a 6% yield on average, it will take 12 years for your money to double to $200.

But, if you have a better yield like 10%, it would only take 7.2 years for your money to double to $200.

This rule is useful if you’re investing lump sums, but if you’re investing more regularly, than I would recommend an investment calculator that has an option for additional contributions.

Strategies For Retirement

So now I want to go over some retirement strategies. I used the same example for all 3 strategies and used an investment calculator to create these tables.

Basically, these are 3 strategies that you have when saving for retirement.

Each strategy is slightly different, but they all show how long it would take to retire when saving a certain percentage of your money.

I’ve always wanted to create tables like this so I can see, how long it would take to retire when saving 20% of my income, or how long it would take if I saved 50%, etc.

For these strategies, we use an example income of $50,000. If you make a different amount of money, these tables should still work for you. They might be a few years off but you should get a ballpark estimate for how long it will take you to retire.

Extreme Strategy

In this table, our example person, John, has an annual income of $50,000, and he is investing in a mutual fund that generates 7% adjusted for inflation.

In this strategy, John’s annual expenses will be the same in retirement as they are right now. Meaning that if he is living on $20,000 now, he will still be living on $20,000 in retirement. But if he is living on $40,000 now, he will live on $40,000 in retirement.

Basically, his current living expenses will always match the living expenses he will have in retirement. So, the more he saves, the less he spends, and therefore, the smaller his nest egg has to be.

I think it will make more sense when you look at the table below.

| Savings Rate | Annual Contributions | Expenses in Retirement | Target Nest Egg | Years Until Retirement |

| 5% | $2,500 | $47,500 | $1,187,500 | 52 |

| 10% | $5,000 | $45,000 | $1,125,000 | 42 |

| 15% | $7,500 | $42,500 | $1,062,500 | 35 |

| 20% | $10,000 | $40,000 | $1,000,000 | 31 |

| 25% | $12,500 | $37,500 | $937,500 | 27 |

| 30% | $15,000 | $35,000 | $875,000 | 24 |

| 35% | $17,500 | $32,500 | $812,500 | 22 |

| 40% | $20,000 | $30,000 | $750,000 | 19 |

| 45% | $22,500 | $27,500 | $687,500 | 17 |

| 50% | $25,000 | $25,000 | $625,000 | 15 |

| 55% | $27,500 | $22,500 | $562,500 | 13 |

| 60% | $30,000 | $20,000 | $500,000 | 12 |

| 65% | $32,500 | $17,500 | $437,500 | 10 |

| 70% | $35,000 | $15,000 | $375,000 | 9 |

| 75% | $37,500 | $12,500 | $312,500 | 7 |

| 80% | $40,000 | $10,000 | $250,000 | 6 |

| 85% | $42,500 | $7,500 | $187,500 | 4 |

| 90% | $45,000 | $5,000 | $125,000 | 3 |

| 95% | $47,500 | $2,500 | $62,500 | 2 |

| 100% | $50,000 | $0 | $0 | N/A |

Extreme Strategy Analysis

So you can see that if you manage to save 80% ($40,000) of your money, and live on 20% ($10,000), you can retire in 6 years. But, you’ll still only be living on that $10,000 a year once you reach retirement.

Obviously, it’s not sustainable to live on $10,000, so that’s not an option. Realistically, the limit for this example is probably saving 60% ($30,000), and living with 40% ($20,000). In that situation, John could reach retirement in 12 years.

The only people that this situation is ideal for are those are extreme cheapskates. You have to make a lot of sacrifices now to reach retirement, and even when you reach retirement, you’ll still have to make the same sacrifices that you were before.

The huge advantage to this strategy is that you could retire very quickly provided that you were saving a large portion of your money.

I guess it could work for anyone saving 40% or less, because they would still have $30,000+ to live on in retirement. Honestly, this decision is all yours. It’s about the sacrifices you are willing to make and the life you want to live in retirement.

But if that strategy is not for you, let’s look at the next one.

Basic Strategy

This is the strategy that most people follow. It involves having a target nest egg that will allow for you to live on a certain amount each year that you predetermine.

In this case, John still makes $50,000 a year and invests in a fund that generates 7%. But now, instead of his retirement expenses matching his current expenses, he has decided to live on $30,000 a year in retirement, meaning he will need $750,000 saved and invested.

| Savings Rate | Annual Contributions | Expenses in Retirement | Target Nest Egg | Years Until Retirement |

| 5% | $2,500 | $30,000 | $750,000 | 48 |

| 10% | $5,000 | $30,000 | $750,000 | 36 |

| 15% | $7,500 | $30,000 | $750,000 | 31 |

| 20% | $10,000 | $30,000 | $750,000 | 27 |

| 25% | $12,500 | $30,000 | $750,000 | 24 |

| 30% | $15,000 | $30,000 | $750,000 | 22 |

| 35% | $17,500 | $30,000 | $750,000 | 21 |

| 40% | $20,000 | $30,000 | $750,000 | 19 |

| 45% | $22,500 | $30,000 | $750,000 | 18 |

| 50% | $25,000 | $30,000 | $750,000 | 17 |

| 55% | $27,500 | $30,000 | $750,000 | 16 |

| 60% | $30,000 | $30,000 | $750,000 | 15 |

| 65% | $32,500 | $30,000 | $750,000 | 14 |

| 70% | $35,000 | $30,000 | $750,000 | 14 |

| 75% | $37,500 | $30,000 | $750,000 | 13 |

| 80% | $40,000 | $30,000 | $750,000 | 13 |

| 85% | $42,500 | $30,000 | $750,000 | 12 |

| 90% | $45,000 | $30,000 | $750,000 | 12 |

| 95% | $47,500 | $30,000 | $750,000 | 11 |

| 100% | $50,000 | $30,000 | $750,000 | 11 |

As stated, this is the path that most people choose that involves living on a little less than they are used to in retirement. This is sort of a balance between the two other strategies, you can still achieve it fairly quickly, and still get a decent amount of money to live on in retirement.

Luxurious Strategy

Finally, this is the luxurious strategy. This is for those who want to have a luxurious retirement.

In this situation, the expenses in retirement will match the current income. Meaning that if you make $50,000 and currently save $10,000 and spend $40,000 a year, you’ll actually be able to spend more in retirement. Because instead of spending $40,000 a year before retirement, now you’ll be able to spend $50,000 a year in retirement.

So this strategy is for those who want to make some sacrifices now in order to live a much more luxurious life in the future.

As you might have guessed, it takes a lot longer to achieve retirement using this strategy versus the others.

| Savings Rate | Annual Contributions | Expenses | Target Nest Egg | Years Until Retirement |

| 5% | $2,500 | $50,000 | $1,250,000 | 53 |

| 10% | $5,000 | $50,000 | $1,250,000 | 43 |

| 15% | $7,500 | $50,000 | $1,250,000 | 37 |

| 20% | $10,000 | $50,000 | $1,250,000 | 33 |

| 25% | $12,500 | $50,000 | $1,250,000 | 31 |

| 30% | $15,000 | $50,000 | $1,250,000 | 28 |

| 35% | $17,500 | $50,000 | $1,250,000 | 27 |

| 40% | $20,000 | $50,000 | $1,250,000 | 25 |

| 45% | $22,500 | $50,000 | $1,250,000 | 24 |

| 50% | $25,000 | $50,000 | $1,250,000 | 22 |

| 55% | $27,500 | $50,000 | $1,250,000 | 21 |

| 60% | $30,000 | $50,000 | $1,250,000 | 20 |

| 65% | $32,500 | $50,000 | $1,250,000 | 19 |

| 70% | $35,000 | $50,000 | $1,250,000 | 19 |

| 75% | $37,500 | $50,000 | $1,250,000 | 18 |

| 80% | $40,000 | $50,000 | $1,250,000 | 17 |

| 85% | $42,500 | $50,000 | $1,250,000 | 17 |

| 90% | $45,000 | $50,000 | $1,250,000 | 16 |

| 95% | $47,500 | $50,000 | $1,250,000 | 16 |

| 100% | $50,000 | $50,000 | $1,250,000 | 15 |

The Takeaway

As you can see, there a lot of options when it comes to planning for retirement. The important thing is that you customize your plan for you. You know the sacrifices you want to make and the life you want to live in retirement. I highly recommend reading: How Much Money Do I Need to Retire?: Uncommon Financial Planning Wisdom for a Stress-Free Retirement (Financial Freedom for Smart People). I encourage you to start thinking and planning for retirement now before it’s too late.