Welcome to this post about how to control your spending habits as a teenager in 2022!

Branded clothes. The latest i-phone. A new ps4. Take-out from your favorite restaurant. Who doesn’t want more of these things? As teenagers, we always want more, thinking that by buying more of these superficial things, the more happiness we get. However, that is not true. You don’t need another shirt to put a smile on your face. You don’t need another video game to make you laugh. In fact, the more you spend on these things, the more trouble you will land in.

Overspending is a huge problem that will continue to grow in the coming years, especially in teenagers. Yes, it is important to enjoy life and do what you love, but overspending is not enjoying life. As of 2022, the average teenager spends $2,150 per year. And for what? Getting rid of clothes that are not trendy anymore? Leaving those video games controller to just sit on top of a table? And, most importantly, wasting money on things that you didn’t even need in the first place?

In order to start controlling your spending habits, it’s first necessary to understand the underlying reasons on why you overspend:

- Spending triggers: Online shopping whenever you’re bored. Going to the mall if you ran out of things to do

- Peer pressure: Do you find yourself spending money every time [insert name here] is around?

- Social media: By seeing only the best of other peoples’ lives, you feel the urge to put up the same appearance. You want others to know you’re doing great too and that can often lead to overspending on food, clothing, vacations, and more.

- Unconscious spending: Nowadays, it has become extremely easy to buy something with a swipe of a credit card or the click of a button.

- Estimating your income, expenses, and spending incorrectly

First of all, kudos to you for recognizing the need to improve your spending habits, and overall, your future, regardless of if you are an overspender or not. We all have those times where we wanted to buy one thing, but came out with multiple bags in our hands. As teenagers, now is the time to stop those spending habits before it becomes a lifestyle. So, without further ado, here are 10 tips to control your spending habits as a teenager in 2021:

1. Understand your spending triggers

In many cases, you spending money is a result of the emotional and psychological triggers that occur throughout the day. Here are some examples:

- Time of Day: Do you find that you have more energy during certain periods of the day? If so, shop during times when you have more energy and feel less stressed. You’ll make wiser spending choices and think more rationally when you’re relaxed and less pressured.

- Environment: Shopping malls, home shows, holidays, etc. Steer clear of such environments that urge you to spend money, and if that’s not possible, only take a few dollars when going out.

- Mood: If you’re bored, do you instantly go on your favorite shopping website or visit the mall? Instead of doing so, tell yourself to go to the gym or the park.

- Peer pressure: Do you tend to spend more money than you normally would when you’re hanging out with your friends? If so, suggest plans that don’t require you to spend a lot of more, like hiking or meeting for coffee.

- Lifestyle: If you grew up in a household where money was always tight, you may feel the urge to overspend to compensate for all the things you were deprived of growing up. Similarly, if you grew up in a household where money wasn’t an issue, you may feel compelled to spend money you don’t have in order to maintain the lifestyle you grew up with.

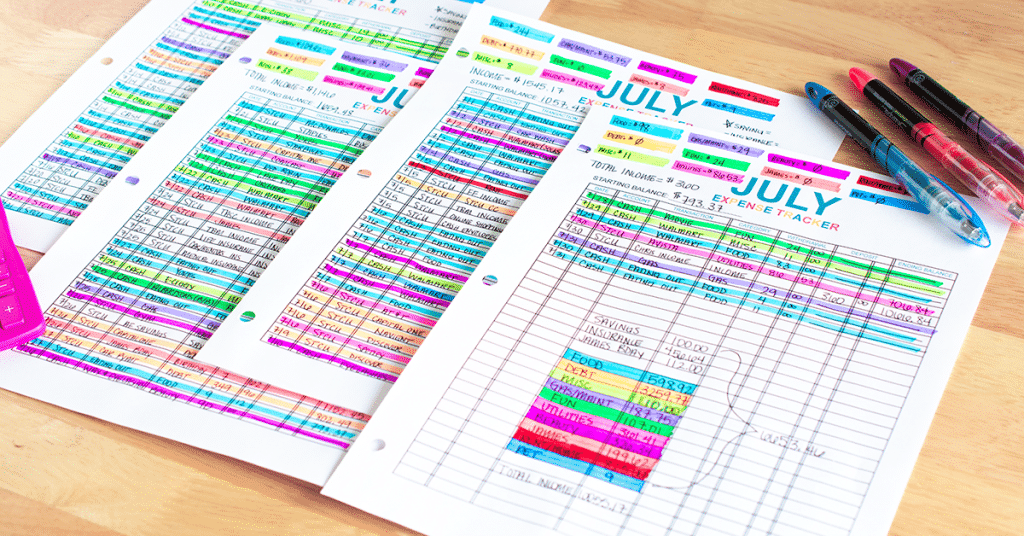

2. Track your spending

It may not seem like it, but every dollar adds up to huge expenses at the end of the month. As a solution, tracking your spending is a great way to budget and keep yourself accountable for each dollar you spend. Once you’re aware of where your money is going, you’ll be in a better position to make smarter spending choices and to identify areas you can cut back in.

Don’t only cut back on the bigger expenses, like a new phone or computer, but also the smaller ones. For example, getting Starbucks each morning for a month only seems like $4 a day, but that adds up to $120 in a month.

3. Stick to cash

It’s more convenient to whip out a credit card to pay for a purchase than it is to count out a wad of bills, but this convenience is one of the reasons behind many people’s overspending. The downside of credit cards is the ease with which you can overspend; when we’re nonchalantly handing over our card to make a purchase, we’re often not aware of how much everything will add up at the end of the month.

With cash, you physically see how much you have, and how much of your funds are diminishing with each purchase. By paying only in cash, you’re forcing yourself to only spend what you have. So, give your credit cards a break and try to stick to a cash-based system to see if it will curb your spending habits. Based on your budget, take out some cash at the start of the week and put it in an envelope, which will act as your ATM for the week. Draw out a few bills here and there to cover your purchases, and if you find yourself running low on cash, you’ll have to figure out a way to make your money stretch.

By paying with cash, you’ll learn how to stop relying on credit and you’ll know how to stop spending money you don’t have. The cash envelope system will also encourage you to become more creative and resourceful. If you overspend and you don’t have enough to go out to dinner with your friends, you’ll have to figure out different ways of saving money, or think of budget-friendly ways to spend time with your friends.

https://www.mymoneycoach.ca/blog/how-to-stop-spending-money-7-tips.html

4. Set finance goals

As said in many of my previous blogs, goals are a great way to go after something, stay motivated and be disciplined! However, it is important to set meaningful ones, because generic ones, like “decreasing spending on eating out” is not going to cut it.

A few tips to help set good finance goals, as taken from my previous blog are to set SMART goals, which stands for:

- Specific

- Measurable

- Achievable

- Realistic

- Time-Bound

It is also important to remember to set both short-term and long-term financial goals, as they both will help you manage and view your finances from a better perspective.

5. Budget your money

A big reason a lot of people can’t stop spending money is that they don’t have a spending plan. “If we don’t know how much we take home each month and how much our expenses add up to, we’ll continue to buy what we think we can afford, only to realize at the end of the month that our bank account isn’t as plush as we thought.” (mymoneycoach)

To help make a budget for yourself, check out our spreadsheet for monthly budgeting!

Once you set a budget, you can use that as a tool to decide how much money you can afford each week and give yourself a reasonable allowance! Just remember, when the money is gone, the spending stops.

6. Understand the consequences

If you go through the process of creating a budget you’ll stick with, you will soon realize that they are serious consequences to your overspending. Some of them include:

- Many of your financial goals will be left unachieved

- Your definition of financial freedom and independence will not be reached

- Your plan to eliminate debt will never get accomplished

Once you realize the negative effects your future will have if you don’t stop overspending, you can immediately stop making the mistakes you made before and save money!

7. Distinguish needs vs. wants

Create a list

Do you really NEED those new Jordans? That blue sweater from the mall? Or do you just want them? Chances are that you only want them and you don’t actually need them. If it is an absolute necessity, then go ahead and buy it; but if it’s not, it’s probably not a good idea to buy it on the spot.

Take the time to think about the impact of the purchase. What will they do for you? Will they make you happy or fill a hole in your closet? Can you afford to buy it and is there something else you want more?

Be honest about how your purchase will impact your life, and then decide if that want is worth the asking price.

8. Only take the money you need

If you follow the third tip in this blog, which is to stick to cash, then you should also follow this one. Only take the money you need when going out to places, like the grocery store or the mall. By following the fifth tip, which is to budget your money, you can figure out how much money you need to take with you. For example, if you take $100 to the grocery store but end up spending more, you can begin to prioritize the items in the cart and put the things that you don’t need back onto the shelves!

9. Institute a cooling-off period

Often when we see a new phone on display or a limited-edition product, one thought looms our mind: I need it. We are overcome by these wants that we often forget about others factors, like its price or value. To help with this, it is advised to take a cooling-off period where we reflect on whether this product is a necessity and look at over budget to see if we can allocate for such a product. This period can last from 24 hours to 3 weeks and if you find yourself forgetting about this product, then you probably do not need it. However, if you do find yourself thinking about it and are able to afford it, then go ahead it.

10. Think about sales differently

“I only buy things if they’re on sale!”

Have you said that before? As a financial coach, I hear it all the time.

Let me help you think about sales in a different way.

It doesn’t matter if something is on sale for 75% off. It’s still 25% on if it’s not budgeted for.

Here’s another way to look at it. If you buy ten items that are typically $100, but happen to be 50% off, that’s no different than buying five of those same items at full price.

If you’re “only buying things on sale”, that won’t matter much if the total number of items you’re purchasing increases as well.

This isn’t saying that you can’t buy something in the moment, but you need to be aware that the money is coming from somewhere. Something else is going to be underfunded if you purchase this item that wasn’t budgeted for.

https://adamhagerman.com/stop-spending-money/

The Takeaway

It takes time and dedication to control your spending habits, especially as teenagers. Every now and then, there will be an urge to spend more than you need to, and that’s totally fine if you do, as long as it doesn’t occur several times! Also, just like it took you months to create these spending habits, it will also take time to get rid of these habits. For example, don’t expect your expenses to decrease by 50% in the first month. Even a couple of dollars is still an improvement! As long as you follow these 10 tips, you will make progress in no time:

- Understand your spending triggers

- Tack your spending

- Stick to cash

- Set finance goals

- Budget your money

- . Understand the consequences

- Distinguish wants vs. needs

- Only take the money you need

- Institute a cooling-off period

- Think about sales differently

For an extra resource, check out this awesome book on “Your New Relationship With Money: Mastering Money, Growing Wealth, and Finding Freedom in a Culture Trying to Make You Broke.” Along with this, be sure to watch this video on how to stop spending money, with 15 tips on stopping impulse shopping and saving money with minimalism.

With that, good luck controlling your spending habits, and comment down below if these tips helped you! Best of luck!