Welcome to the College Savings Calculator! This is a great tool to quickly figure out how much cash you’ll have by the time you start college, and will help you have a much clearer look at your financial picture and to see whether you’ll have enough, need some scholarship money, or find some alternative means for avoiding student loans.

College Savings Calculator

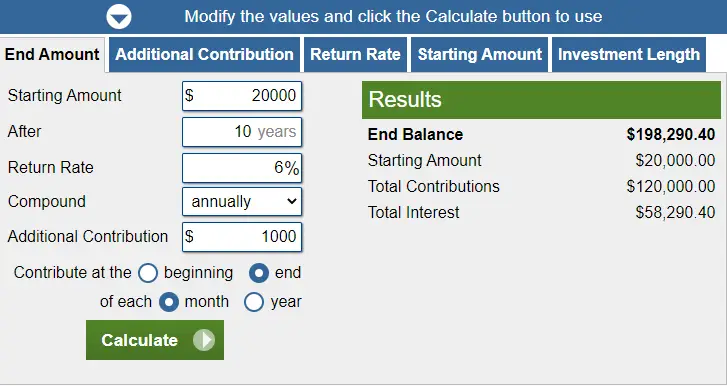

The best college savings calculator that we have found at Teen Financial Freedom is this one right here:

https://www.calculator.net/investment-calculator.html

Earning vs. Investing

As a young person, by far the two best things you could do to save up for college is earning cold hard cash, and applying for scholarships.

This college savings calculator is useful, but don’t fret over trying to find a high rate of return for your money. At least beating inflation is a great goal (but don’t put your savings at risk to do that).

The reason I say that is because even if you started saving your cash for college in middle school at the age of 12 (which would be an incredible head start), you still only have six years until you’re graduating high school and you’re ready for college!

There simply is not enough time for compound interest to work it’s magic and grow your money by any significant amount.

I’m not downplaying compound interest. It’s effects on your money over a period of time is HUGE! It is a bit more difficult to see the power of it when your savings goal is short term though.

All I’m saying is as a middle schooler or high schooler, you’re better off focusing on how to earn more money through a job or business, or by searching for scholarships and grants, rather than stressing over a high rate of return.

Saving Vehicles to Consider

The national inflation rate is currently 2.49%. Our goal is to find an account that is safe for your money and yet offers a high enough return to beat inflation (or as close to beating it as possible).

Savings Account Options:

- Discover Online Savings Account (Minimum balance $0, APY 1.6%)

- CIT Bank Savings Builder (Minimum $100 deposit, required $100 monthly deposit for highest APY of 1.75%)

- Ally Bank Online Savings Account (Minimum balance $0, APY 1.6%)

Here are two links to a compilation of savings account options:

- Best Online Savings Account – Top 7 Banks to Start Making Interest Today!

- Best High Yield Savings Accounts – up to 5% APY

Money Market Accounts:

I was hoping money market accounts would have a significant rate of return advantage over a regular savings account, but unfortunately that does not seem to be the case. At a quick glance from BankRate the current returns from a money market account are about the same as a savings account.

Still, if you’re looking for other options, this could be one you can consider!

Cryptocurrency Stablecoins:

Heads up: This is merely just a thought I had when I was strategizing about how to beat inflation. Talk to professional investors, your parents, and do your own research before you charge head long into the crypto space. There are risks involved, but if you know what you’re doing it can definitely be worth it. At the very least, the idea below is good food for thought. 🙂

Something totally crazy you could consider is saving your money in a stablecoin like USDC or TruUSD and then depositing your stablecoins into BlockFi or Nexo.

The reason I suggest that (and I’m about to implement this strategy myself, I already have a Coinbase and Nexo account setup) is because I was disappointed by the fact that even the best savings accounts out there will still lose you almost 1% to inflation every year!

BlockFi and Nexo are services that will pay you up to 8% in daily compound interest for your crypto holdings. Now, for something like college savings I would not recommend dumping it in Bitcoin and then depositing it into BlockFi to earn interest, because Bitcoin’s value is allll over the place. I consider it a legitimate investment, but not particularly a reliable savings vehicle.

My Recommendation

Now what I could suggest (dudes, keep in mind this is not financial advice and merely a 16-year-old’s musings) is to buy USDC with your dollars and then deposit your USDC into Nexo or BlockFi.

The reason I say that is because USDC is a stablecoin backed by the US dollar, so one USD Coin will always trade for one dollar.

So if you think about it, you’re basically just digitalizing your US dollars and earning an 8% APY!

If you’re interested in learning more about BlockFi and Nexo I highly recommend checking out this article comparing the two services.

Now that might seem like a completely crazy idea to some people, and yeah, crypto is a new space and there are risks, but if you do your own research and find it appealing, by all means, give it a go! I’m just letting you know that option is out there.

How to Save More for College

#1: Make a Plan (and stick to it)

Making a plan for college is huge (specifically a financial plan)! If there’s one thing I regret not doing, it’s not taking college seriously enough and planning out my strategy and financial plan sooner. Doing so could have knocked up to one or two years off my time spent at college!

First, make a plan for your academics. You could start this as early as your freshman year in highschool, but you should definitely have one by the end of your sophomore year so you can use the last two years of high school to implement your plan. Figure out what your goals are for college and what the best way to achieve those goals are.

Ask yourself questions like “What kind of degree am I interested in pursuing?” or “Which college or university am I thinking about attending?”

What kind of test scores do I need? Can I use a dual enrollment program or CLEP tests to cut down on my time spent in college?

Secondly, make a financial plan. Figure out how much tuition is at the college or university of your choice. How much do you need to save? Will you have to go into significant student loans to graduate from that college?

How much can you earn beforehand from part time jobs and small businesses? Can you utilize scholarships and grants?

Once you’ve planned things out academically and financially and implemented your plan, you’ll have a great base off which to start college and can avoid the devastation of thousands of dollars in student loans.

#2: Find a Job (or start a business)

Obviously to save money you have to earn it first! The most effective thing you can do to save more money is to build a sizeable income. If you live in the United States, there a no excuses!

There a million different ways you can make money, whether its through a part-time job, a small business you run in your neighborhood, an online business, or just odd jobs you get offered.

#3: Track Your Finances

As you start earning more money it is very important that you build the habit of tracking where your money goes.

The reason this is important is because as teens learning to become young adults and manage our own money, we have to learn what the good and bad things we spend our money on.

I know also from personal experience that if you merely deposit a check from your job and proceed to spend the money without seeing where it’s going, you’ll have a multitude of leaks in your cash flow that appear over time without you even noticing!

The good news is, technology nowadays makes that ridiculously easy! By linking a service like Toshl or Personal Capital to your bank and investment accounts, you can easily see a compiled history or where your money is flowing.

For example, you might check your money management app one day and realize that you’re starting to spend a little more than you should, and your savings are slipping.

Or, you might notice a recurring subscription for a service you don’t use anymore that is charging you every month!

You could also easily see that you’re starting to spend a little too much money on fun things like eating out or video games, and it’s time to pull back the reins a little bit.

Just merely browsing your bank account transaction history doesn’t cut it – have a dedicated app that compiles your expenses and savings and gives you a regular report.

The Takeaway

Saving is a very important habit to build to set yourself up for financial success in the future. There are savings for emergencies, investing, buying a car or house, and as we’ve discussed in this specific post, college!

Saving for college is one of the best things you can do as a highschooler to avoid massive student loans later in your life that will tie you down. Build the discipline now to save for your college expenses and have the freedom of graduating debt free! This calculator is a great way to start looking at how to do that. And, for another resource, check out, “College Bound: How to save and budget your money to a debt-free graduation!”