Welcome to Best Ways To Start Investing With Little Money!

The best way to start working towards financial freedom is investing. It’s important to do some long-term thinking when it comes to your finances. If you’re able to start investing now, it might lead to early retirement or to becoming a millionaire one day.

The problem people seem to have is that they don’t have ‘enough’ money to invest. The truth is, there’s no magic amount of money that means you should start investing. You should start now even if you don’t have very much to invest!

High-Interest Savings Account

When you start thinking about investing the first thing you should do is move your money to a high-interest savings account. Although it may not seem like it, high-interest savings accounts will yield you a lot of money long term. They can be a great source of passive income if you are able to get a considerable amount of money in the account. For example, if you have $10,000 in an account that generates 2% interest, you can make $200 a year for free! The more money you put in, the more you get out.

Monthly Investments

If you’re serious about getting into investing, I’d recommend incorporating it into your budget. Set aside an amount each month that you would like to invest. It doesn’t have to be a large amount, but do something that you can stay consistent with. You don’t have to invest this money right away, but hang on to it until you’re ready to make an investment.

Check Out 10 Budgeting Tips for Teens!

Spare Change

In addition to investing a portion of your income, you should also invest all of your spare change! Usually, people seem to not value spare change. They tend to give it away or lose it. This is such a bad habit! You’re throwing away free money!

Instead, you should hang onto your spare change and keep it in a jar. Save for a couple of months and you’ll find a couple hundred dollars ready to be invested. Instead of throwing this money away, you can invest it and watch it grow!

If you’re interested in putting this spare change to work, consider investing in fractional stock shares on the teen investing app, Bloom!

Acorns

Speaking of spare change, Acorns is a popular app that rounds up every purchase you make and invests it. For example, if you buy a meal that costs you $7.47 Acorns will round that purchase up to $8 and invest the extra $0.53.

Robinhood

A great app for investing is Robinhood. Robinhood offers user-friendly investing across a wide variety of investment types. They charge no commission fees, service charges, and don’t require an account minimum. On the other hand, they don’t offer mutual fund investments or retirement plan investments.

Betterment

Another great resource is Betterment. Betterment also has no account minimum but they do charge a .25% management fee. Unlike Robinhood, Betterment has retirement plan options and is goal-oriented.

Lending Club

Lending Club is a website that connects investors with borrowers. This website has a minimum investment of $1000, but you rest assured that you’ll get your money back because Lending Club requires borrowers to have a high credit score. Although it may be riskier, the interest rates are much higher!

Business

Sometimes this is overlooked, but a good investment to make is in your own business! Whether it means purchasing a new software, advertising, or outsourcing your work, do something that will boost your profits and increase your efficiency! Investing in your own business can have great returns!

Diversify

When it comes to investing, it’s important to diversify your investments. There will be many instances where your investments backfire and you lose money. If all of your money is in one type of investment, this could be tragic. Take steps to diversify your investments and you’ll see much better results.

Long Term Effects

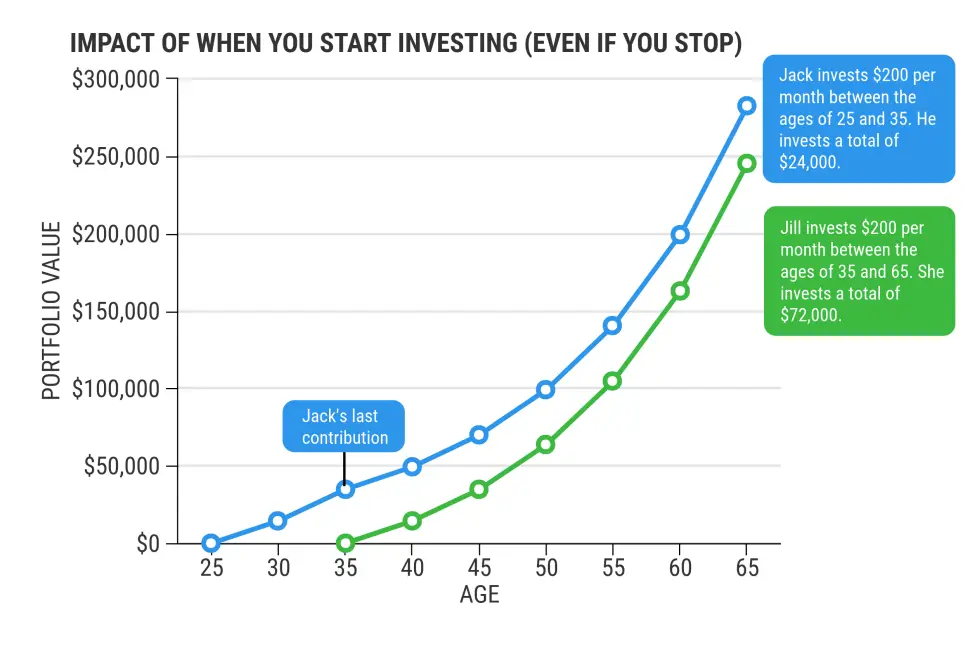

Right now, it might seem like a lot of work to start investing. It probably doesn’t seem worth it to set all of this up and receive very minimal results. But, you have to remember that all of this is for long term financial freedom.

Here’s an example for you. In this example, Jack invests $200 a month between ages 25-35. Jill starts later but invests longer. She invests $200 a month from ages 35-65. In the end, even though Jack stopped making contributions, he still made more money. If we would have continued to contribute he would have made even more money.

The Takeaway

It’s imperative that you start investing now! Don’t wait any longer! The longer you wait the more money you are throwing down the drain. For more information on this topic, be sure to read: A Beginner’s Guide to the Stock Market: Everything You Need to Start Making Money Today. Even if you don’t have a lot of money to invest right now, invest it anyway. The earlier you do that the more money you will make!