Welcome to 10 Tips On Budgeting For Teens!

Budgeting Tips

Throughout my life, I’ve made huge mistakes when it comes to budgeting. My most recent one was spending $100 a month on fast food for me and my friends. That may or may not sound ridiculous to you, but it sounds ridiculous to me. Last semester, my 3 friends and I would go out to eat every day. We’d take turns paying for everyone. All of a sudden I had racked up $100 spent on food in just 20 school days. Whereas instead, I could’ve bought lunch at school or brought a lunch and used my parent’s money. So essentially, I wasted $100 a month, or $500 in a semester simply by going out to eat everyday. It was a major budgeting mistake. Fortunately, in my case, I had enough money to spend on all of my other expenses. However, in many teens’ cases, they don’t have the money to do that or don’t have a clue on how to budget at all. So this guide is for you! Here are 10 Budgeting Tips for Teens!

1. Estimate Your Monthly Income

The first step to budgeting is to calculate your monthly income. Add up all streams of revenue that you have and calculate a monthly average (be conservative). Use this number as a guide to how much you should spend each month. Obviously, your spending should never exceed your income.

2. 30/30/40 Rule

As a teen, the typical thing to do is to blow all of your money on trivial items or on junk food. Don’t worry, I’ve been there. However, there’s a better way of budgeting your money. It’s called the 50/30/20 rule. I’m sure you’ve heard of it, but just in case you haven’t, experts suggest that you spend 50% of your money on your needs, 30% on your wants, and 20% on your savings. This is a good rule of thumb for most people, however, it does apply a little differently to teens. Most teens don’t need to spend 50% of their money on their needs. Their parents pay for most of their expenses for them.

The biggest necessary expenses for teens come in the form of car payments, insurance payments, and phone payments. However, teens tend to spend most of their money on their wants like food, clothes, and accessories. Teens luck out on not having to pay for rent/mortgage, student loans, groceries, and other expenses that are covered by their parents. Though, there are exceptions out there.

Because of teens’ different styles of spending, I suggest a 30/30/40 rule.

- 30% Needs: phone, car, insurance, groceries, other bills

- 30% Wants: clothes, fast food/junk food, electronics, accessories

- 40% Savings: savings account, emergency fund, college savings, retirement savings, investing

Now it’s important to note that I do understand there are exceptions out there. Sometimes, your needs may be way higher than 30% of your income and there’s not much you can do about that. If that’s the case, lower your wants as much as you can, and take the rest out of what you would put in savings.

My Spending

Last month, I made considerably more than my regular income; however, my needs and wants stayed the same. As a result, I ended up spending 15% on needs, 16% on wants, and 69% on savings. I am lucky to have low need-based expenses, but I’m still proud that I took the extra money I made and saved it. On a more regular basis I usually spend 22% on needs, 20% on wants, and 58% on savings.

Don’t have an income? Start a business that makes money while you sleep!

3. Come Up with Spending Categories

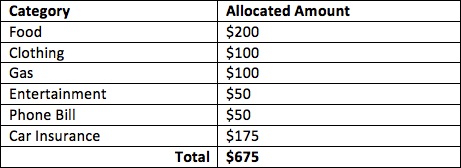

Once you have your estimates for what you should be spending on your needs, wants, and savings each month, come up with some spending categories on things that you regularly spend money on (clothes, food, gas, gifts, bills, etc.) Take some time to think about how much of your income you want to set aside for each one of these spending categories (Ex. $40/month for clothes).

The important thing to imagine when budgeting is that each spending category fund that you have is its own separate bank account. You never want to spend more than what is inside that account. For example, if you have $200 in your clothes fund, you shouldn’t go and spend $80 on shoes and $140 on some new pairs of jeans, because that would equal $220. Just because you have $4000 in your bank account, doesn’t mean that you have $4000 in your clothes bank account (spending fund).

If you happen to not spend all of the amount in that category, then simply just carry it over into the next month and start to grow your funds! The whole point of budgeting is to restrict the amount that you spend to the amount that you allocate for that category. Just think about how much you have to spend on a category, and don’t go over that unless it’s absolutely necessary. If you follow that one simple rule you’ll be saving money in no time.

4. Track All Expenses

A huge part of budgeting is tracking all of your expenses. This way, you know exactly how you are spending every dollar that you have. Every time you spend money, even if it’s only $1, record it. I recommend HoneyMoney. It’s a great online tool that you can use to track your expenses and financial progress. Start your free trial here.

At the end of the month, add up all of your expenses and input that into your budgeting spreadsheet (See Tip #7).

Tip: When tracking your expenses, always round up to the next nearest dollar. But, don’t throw away your spare change, hang on to it and keep it in a jar. This way, when you cash in your spare change, you’ll be pleasantly surprised to find you had an extra $100 sitting around.

5. Build Emergency Fund/Savings Account

Experts suggest having at least 6 months’ worth of income in a savings account/emergency fund. This money would be used in case of emergencies such as losing your job, needing car repairs, or paying for expensive medical bills. If you made $500 a month then you should have $3000 in an emergency fund account ($500 x 6). If you’re saving 40% of your income like I suggest then you would be depositing $200 a month into savings. It would only take 15 months to reach the point where you have enough in your savings/emergency fund. However, once you reach the point where you have 6 months worth of income, don’t stop! Keep growing that amount as high as you can! You’ll need it eventually.

When you’re saving, think about having multiple imaginary savings accounts inside your savings account. If each month you set aside $30 for car-related expenses, but don’t spend all of that money each month, just start to total up the amount of money you have in that fund. Eventually, you’ll have hundreds of dollars saved specifically for any car repairs or maintenance that you may need. You can do that for your car, college savings, emergency fund, and so much more. Maybe your savings account says $10,000, but really $4000 is for emergencies, $3000 is for college, $2000 is for car expenses, and $1,000 is for spending.

6. Treat Savings Like an Expense

You need to treat saving like an expense. If you make $500 a month then plan to put $200 in savings every month. Consider making automatic payments either from your bank account or directly from your employer to either your savings account, emergency fund, or college savings account. This way you never are tempted with the extra money in your account, because the money is safely deposited into a non-spending account. However, if a surprise payment comes up, it’s okay to not put in the regular amount into your savings, or withdraw from your savings. Just don’t use that as an excuse to spend more on your wants.

I make automatic payments every month of about 40% of my income directly to my college savings account.

Read more about putting savings in emergency funds, college accounts, investments and retirement account here.

7. Keep Track of Your Finances Monthly

The key to budgeting is keeping track of your finances monthly. I have a budgeting spreadsheet that I use. There’s also a fantastic budgeting spreadsheet that you can get here from Frugal Fanatic that offers some amazing features.

- Monthly Budgeting Templates

- Annual Income and Expense Reports

- Graph and Percentage Reports for your income and expenses

It’s so important to track your finances every month to see how much you’re spending on all of your expenses. I’d recommend uploading your expenses from your expense tracker as well as inputting your income to fully track where all of your money is going.

8. Keep Track of Total Assets

I’d also recommend keeping track of your total assets. Every few months, take some time to add up all of your assets. This includes bank accounts, digital payment app accounts, investment accounts, college savings accounts, stocks, cash, and spare change. Add all of this up and get a rough idea of how much total money you have. If you do this consistently enough, hopefully, you’ll see progress as you continue to work towards financial freedom!

9. Have an End Goal When Budgeting Your Money

With all of this, it’s important to think of your end goal. Maybe for you, it’s saving for a vacation, paying off student loans, or not being so stressed every month. For me, my end goal is saving for college. Right now, all of my work is going towards paying for college. Read more on how to pay for college here. Walking out of college debt-free is a huge goal of mine, and that’s what I think about when I have to make financial sacrifices.

But also, think about things that you want to buy, such as a new phone. Suppose it costs $500. You can incorporate saving for your phone into your budget. Try saving $50 a month for a few months. Once you’re ready to buy it, put your down payment on it of $200. Then make monthly payments of $25 for the next year to pay it off. Add this into your budget to spend more wisely!

10. Make Budgeting Fun

This might sound crazy to you, but make budgeting fun! Treat it like a game where you are trying to save as much money as possible while watching your savings accounts grow exponentially. When you make this fun, you’ll start to take huge steps towards financial freedom for the rest of your life.

Want more budgeting tips? Get this eBook on amazon that has 200 more tips for saving money here.

The Takeaway

That’s it! I hope you enjoyed those budgeting tips for teens! Now you should have all the skills you need to succeed at budgeting your money! Best of luck!